The #US dollar accentuates its downward trajectory, with the #DXY index (which measures the value of the dollar against the world's six major currencies) accumulating a drop of around 6% so far this year, which increases to 11% if measured from the March highs.

There are several reasons for this trend, from the Federal Reserve's commitment to maintain an unprecedentedly accommodative monetary policy and a highly expansionary fiscal policy that has resulted in a record fiscal deficit in the US, to the recent news of progress on vaccines, which maintains a greater appetite for risky assets in the markets. It is these expectations of an economic reflation process that incline us to believe that dollar weakness will continue into #2021 and that the inverse relationship we have been observing between the dollar and equities will remain strong.

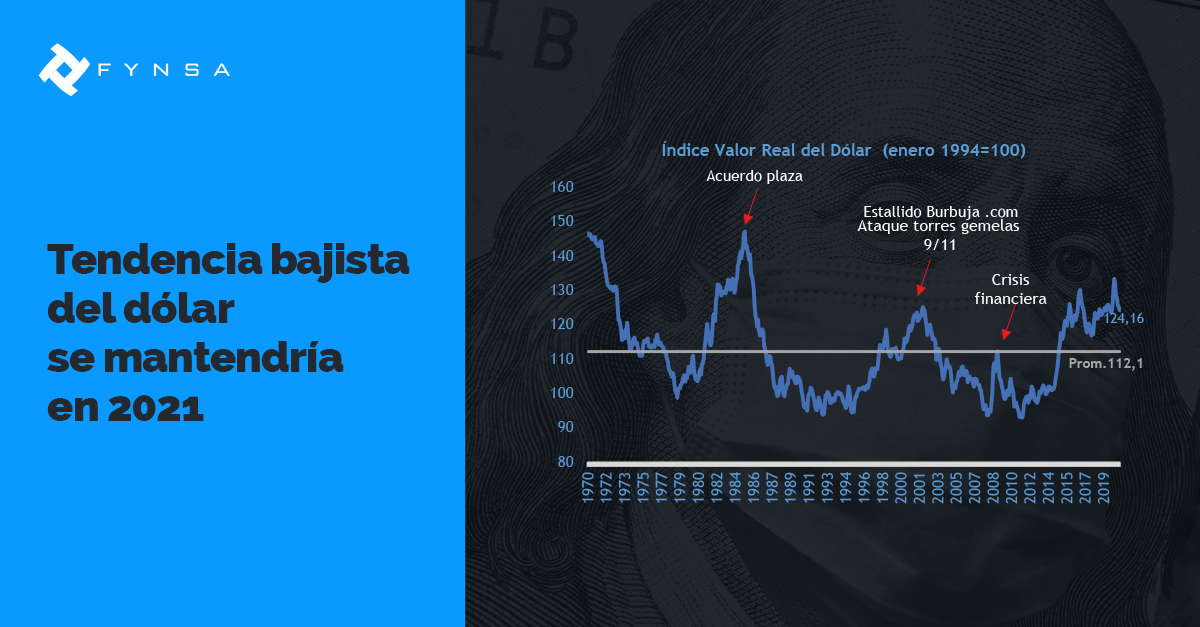

Despite the recent adjustment, the dollar remains 10% overvalued in real terms relative to its long-term averages (Humberto Mora, senior investment strategist, #FYNSA).