It has been an interesting year in real estate. Especially in the US, one of the most dynamic markets in this asset class.

The pandemic forced the vast majority to stay and work from home, at least for a while. The hotel and office market suffered high vacancy levels, and people's higher disposable income was channeled into online shopping, generating high demand for industrial assets.

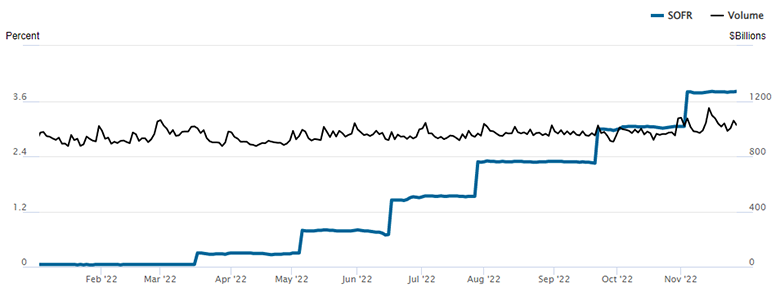

2022 has been characterized by the need to control inflation. The Federal Reserve has raised rates to 4%. On the other hand, on the long end of the curve, 30-year mortgages doubled from levels below 3% to 7% in the last 12 months.

According to different sources, the housing deficit in the U.S. is close to 4 million homes, with the highest percentage concentrated in lower-income sectors. At an aggregate level, there are a total of 127.6 million families in the U.S., and about 1.8 million families are created annually. .

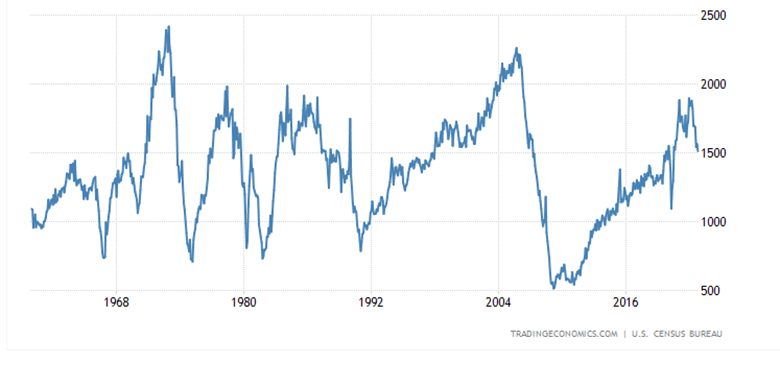

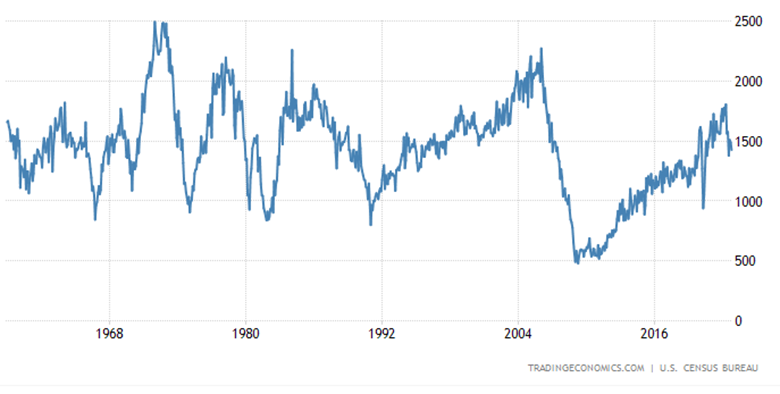

Both building permits and construction starts had been showing upturns since 2010, when the post-financial crisis lows were reached. This can be seen in the following graphs:

Construction permits

Housing starts

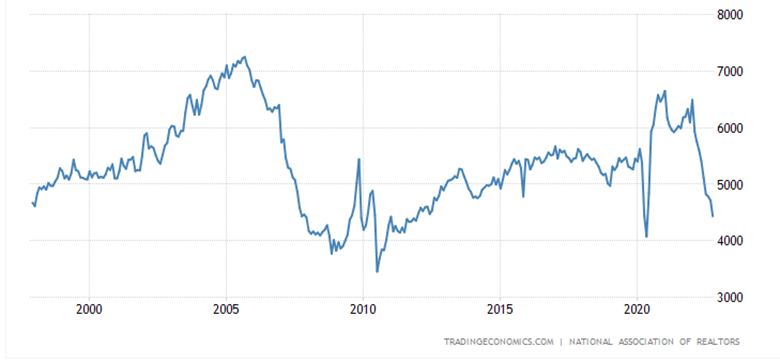

Sale of existing homes

Inventory of homes for sale

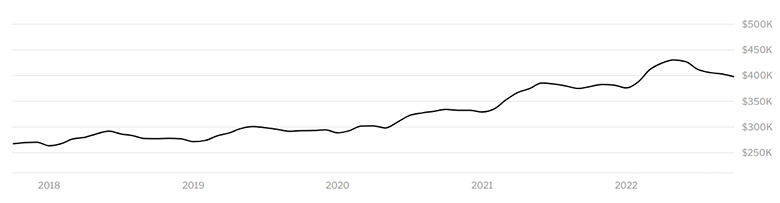

The housing shortage, low interest rates, higher disposable income and savings capacity that occurred in the pandemic, helped housing prices continue to rise. Thus, in the last 5 years, the average price rose 48% according to the specialized site Redfin.com. Meanwhile, the average family income rose 25% in the same period.

Average home price

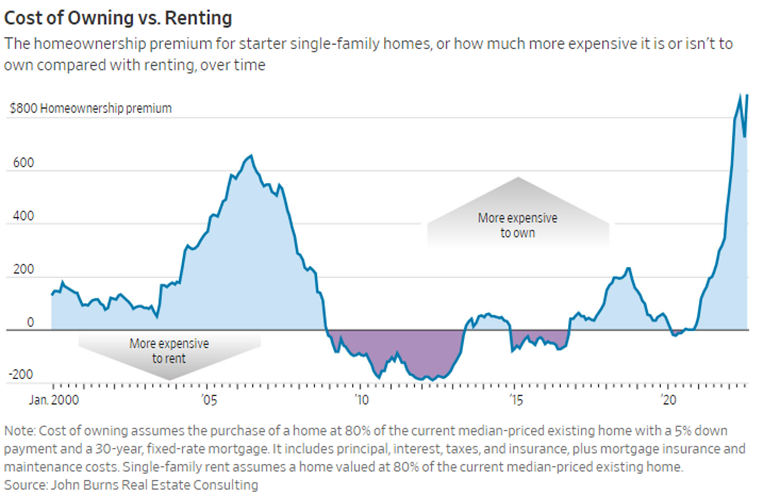

High housing prices plus the rise in financial costs and the fall in disposable income (inflation, return to office) have led families to postpone their purchase decision. In fact, the following graph shows that today it is much more expensive to buy than to rent a house.

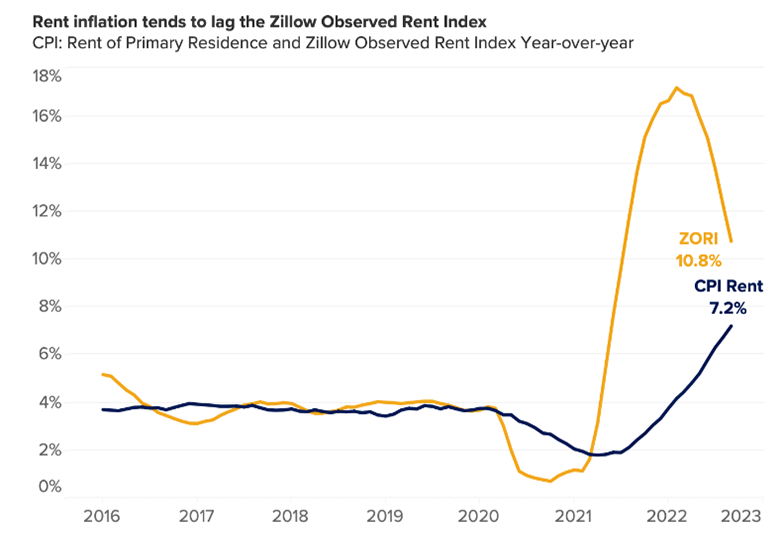

This is clearly attractive when it comes to investing in Residential Income. Of course, the strategies and the equity/debt structure of these must be well understood. Rents will not continue to rise as they have in recent years, and to some extent we can already see an inflection point in rent increases, as can be seen here:

We are facing a market where, despite the adjustments we are seeing, there are still opportunities, as long as we focus on the segments where the needs are most evident.

The shortage and need for access to housing remains. Deficit of +4 million housing units.

Rising construction costs, rising financial costs, rising property prices make home buying less affordable.

It is cheaper to rent than to buy, or at least it impacts disposable income less.

Lease price variations will tend to moderate.

Juan Eduardo Biehl

Commercial Managing Partner of Fynsa