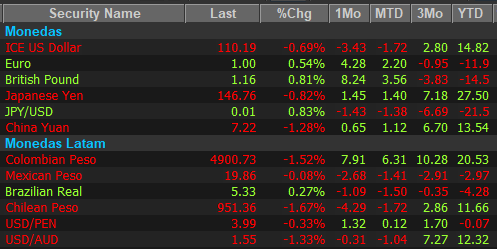

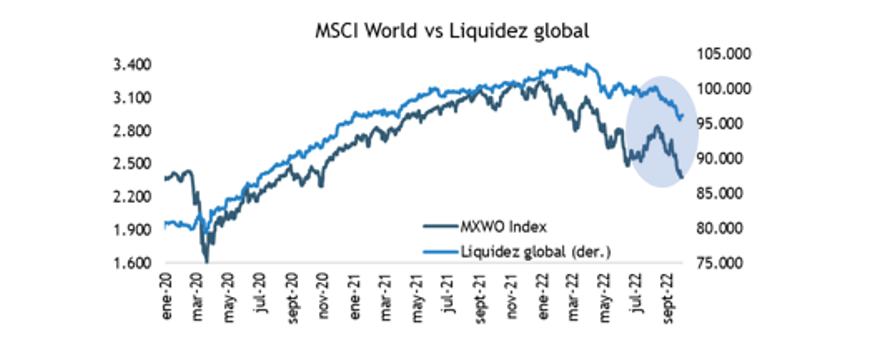

The FED (US Federal Reserve) is causing no small problem in the world by raising the rate so quickly, which has generated a strong appreciation of the dollar in the world, complicating the rest of the developed and emerging countries. For a long time, the FED was in QE mode. This means that it bought bonds from the rest of the market and delivered dollars. Well, by raising the rate and cutting this methodology, it has caused a shortage of this currency in the world.

Fed ends QE - raises rates

The rise in the price of commodities and oil also produces a withdrawal of dollars, which are traded in the same currency. Especially those economies that need this currency, which is basically the case of the developed economies.

developed economies. See following chart

In conclusion, we can say that the appreciation of the dollar against the currencies of developed countries is causing, in definitive, liquidity problems in the world. The question is, until when?

What to expect?

We see the US dollar as highly valued, but clearly there are good reasons for now. We think a starting point is a less aggressive Fed going forward.

The dollar is the de facto currency for international trade and its excessive use is squeezing dozens of nations. Why is its appreciation increasing? Here is a summary of the economic contingency:

The Fed's determination to address inflation again raises funding costs and keeps global markets under pressure.

Investors also have to deal with news from around the world. China is showing new signs that its economy is slowing down much more than projected.

At the October meeting, the Central Bank decided to raise the rate by another 50 bps, in line with market expectations, to leave the MPR at 11.25%.

Francisco Muñoz

Commercial Partner-Managing Partner