Indeed, Graph N°1 shows the changes in the real and inflation components of the 5, 10 and 30-year nominal yields for the US, the euro area and the UK over the last two weeks. As can be seen, part of the increase in real yields has come at the expense of inflation prices in the US.

This is where one can make the first counterpoint. This behavior of higher real yields and lower traded inflation generally corresponds to the market's perception of a tightening of monetary policy, something that is probably too early in the cycle for many central banks to consider (indeed, the ECB highlighted (in fact, the ECB explicitly highlighted real yields as something to monitor, and the Fed chairman himself and the Fed Chairman himself delivered a rather accommodative message in his appearance before the US Congress this week).

While the recent rise in real yields has not been large enough to cause central banks to retreat, one would assume that there are levels beyond which they will do so.

We have argued that a gradual rate hike was to be expected given the recovery first of inflation expectations and more recently of growth, given the progress of the vaccination process, but not the speed with which they reached levels that could be considered more fair value. fair value by the end of 2021. In short, it is the speed of the movement rather than the trajectory that is stressing the market.

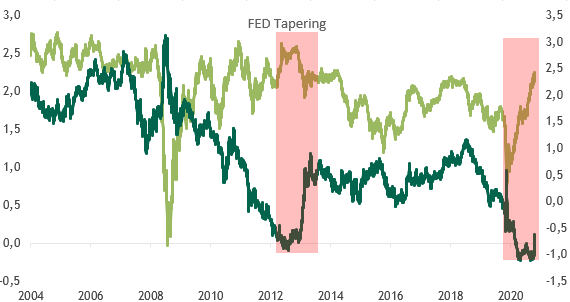

When the Fed showed signs of normalization in 2013 (i.e. 4 years after the financial crisis), inflation expectations were closer to 2.5% and had already been consolidated above 2.0% for some time. Today they are barely above 2.0%, considering that today they are also aiming at an average inflation target of 2.0%, which means greater tolerance to some inflationary persistence (see chart No. 2).

Moreover, the 2013 taper tantrum was the result of an explicit communication from the Fed to start withdrawing the post-financial crisis stimulus (slowing asset purchases in a first stage). (slowing down asset purchases in a first stage), and we have none of that today.. While it is true that the conditions are being created for a reflationary process, given the massive monetary and fiscal stimulus, it is also true that we are in a fairly early stage of economic recovery and not without risks.

Graph N°1: Decomposition of the nominal yield settlement during the last two weeks; in bps

Chart No. 2: Real and breakeven inflation rates 10y US