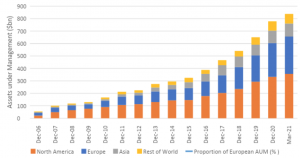

Investment funds that focus on alternative assets have continued to increase in size over the past two decades, and the infrastructure fund industry is no exception.

During 2021, certain interesting metrics were observed in this asset class, highlighting, for example, that the largest fund raised during 2021, for US$ 18 billion, corresponds to infrastructure with a focus on developed regions. This sub asset class is also the one that receives the most interest from sovereign wealth funds, receiving around 7.3% of their portfolios and with individual commitments of around US$ 156 million..

The data provided by ACAFI shows that the number of funds investing in infrastructure in Chile continues to rise, reaching a total of 26 funds and an AUM of US$ 1,651 million as of 3Q 2021, which represents a 300% growth in the last 4 years.. These Funds specialize in financing different initiatives via equity and/or debt, including roads, hospitals, desalination plants, transmission lines, LNG plants and power plants, initiatives that help improve the quality of life of the people.

FYNSA actively participates in this segment of Funds, highlighting its FYNSA Energía and Rockville Solar Energy Funds, which together represent 5.51% of the total AUM of the Infrastructure Funds. Through this platform, capital has been raised to enable the development and construction of 200 MW in clean and renewable energy projects, providing an amount of energy equivalent to the consumption of more than 125,000 homes annually.