Over the past few days, markets have been much more volatile and sensitive to headlines stemming from the new COVID variant, Omicron. However, at the moment data on Omicron is scarce, information in some cases is contradictory and some media have been exaggerating the risks and highlighting worst-case scenarios.

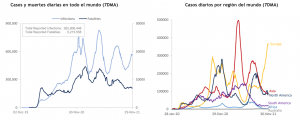

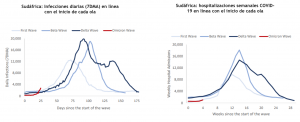

While the full impact of Omicron remains uncertain, Delta continues to fuel infections, particularly in Europe, which remains the epicenter of the recent resurgence of infections globally. Asia and Africa also show a slight uptick in infections.

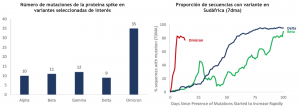

Genomic sequencing data suggest that Omicron may be spreading rapidly in South Africa and possibly displacing other variants.

The pandemic is accelerating again in South Africa, but the culpability and virulence of Omicron have yet to be established.

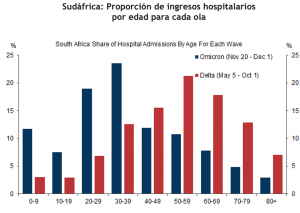

The age composition of hospital admissions for the Omicron wave in South Africa has been younger than in the Delta wave, which is consistent with older people benefiting from their higher vaccination rates or infections being more concentrated in the young so far.

Source: Goldman Sachs

The Federal Reserve must decide

The question now is whether the emergence of the new strain of the coronavirus will cause central banks and in particular the Fed to pull back from raising its policy rate. Will it cause the Fed to worry more about risks to economic growth rather than inflation?

The Federal Reserve will have to review the situation and decide how it will act. Worse inflation may be ahead, but the economy may face a slower recovery. In this regard, another factor that has been generating some concern in the markets was the fact that Federal Reserve Chairman Jerome Powell bowed to the insistent price pressure in the United States and assured the Senate Banking Committee this week that it is time to withdraw the transitionalism when referring to inflation. A change of script that was accompanied by a veiled possibility that the US central bank will accelerate the withdrawal of its stimulus at the next meeting scheduled for December 14-15.

While there are still reasonable doubts about the more definitive impact of the Omicron variant, we believe it adds to the downside risks, (at least for the near term) to the economic outlook, which were already increasing with the winter increase in infections in the US. In these circumstances, it seems unlikely to us that the Fed will accelerate the pace of QE tapering at the December FOMC meeting. On the other hand, there is some debate as to whether Omicron will increase inflationary pressure, if it affects supply more than demand, but the collapse in energy prices suggests that, at least initially, the impact may provide some respite from inflationary pressures.

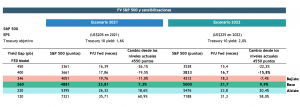

For now the market is leaning towards a slightly faster normalization of monetary policy, although 2 or even 3 rate hikes by 2022 is still part of the baseline scenario and should be well absorbed, if the prevailing dynamics are of higher inflation, but also of growth that would remain solid.

The market has begun to incorporate faster Fed normalization given the increased inflationary pressures.

And the flattening of the yield curve (slope of the 10y2y curve) poses an additional difficulty for the Fed with the market incorporating a "policy error", a thesis we do not share.

Strategy

While Omicron is likely to be more transmissible, early reports suggest that it may also be less deadly, which would fit the pattern of virus evolution observed historically. Should these trends be confirmed in the coming weeks, could the Omicron variant ultimately prove positive for risk markets, in that it could hasten the end of the pandemic? If a less severe and more transmissible virus quickly displaces the more severe variants, could the Omicron variant be a catalyst for transforming a deadly pandemic into something more akin to seasonal flu? Such a development would fit with historical patterns (duration and number of waves) of previous respiratory virus pandemics, especially given the widespread availability of vaccines and new therapies that are expected to work across all known variants (Pfizer, Merck).

A recurring question these days is whether the recent market adjustments represent a buying opportunity especially in the cyclical segments of the market, commodities and reopening issues, which has been particularly hard hit these days.

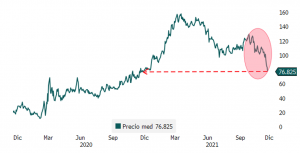

"Buy the Dip" have proven to be an effective strategy this year. If you look at the attached chart, we have had at least 5 correction events averaging 5% in the S&P 500 and all have ended at new highs.

In principle, we are inclined that the recent correction will not end up being the exception and may be a good entry point already thinking about 2022, where our estimates point to an S&P 500 closer to 5,000 points (+10%).

Source: Bloomberg

Humberto Mora

Strategy and Investments FYNSA