The July FOMC meeting offered little new information. While the FOMC added language changes to its post-meeting statement noting that "the economy has made progress toward" its employment and inflation targets since December, it balanced with language noting that the FOMC "will continue to assess progress at upcoming meetings." In addition, Chairman Powell said that the labor market still has "a long way to go" and "some ground to cover," and that "we are a little ways away from having made further substantial progress."

On inflation, Powell repeated his assessment that it has risen "markedly" and cited continued bottleneck pressures, but reiterated the Fed's expectation that inflation is likely to slow in the coming months. He also reaffirmed that the Fed is ready to deploy its tools if inflation expectations rise undesirably, but emphasized that this is not its base case.

The statement also expressed somewhat less concern about the impact of the virus on the economy, which was somewhat surprising in light of the five-fold increase in new cases since the June meeting. However, Powell balanced this in his press conference by acknowledging that the Delta variant could cause people to withdraw from high-contact activities or delay their return to the labor market.

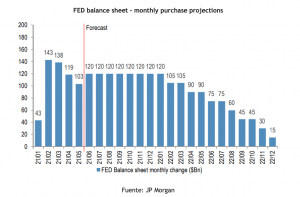

Starting the countdown to tapering asset purchases? Powell noted that the FOMC discussed the pace and composition of tapering at its July meeting, but made no final decision. A reduction in the Balance Sheet still seems most likely to us by 2022. (With a more formal announcement of the tapering plan in December).

Overall financial conditions remain accommodative, reflecting in part policy measures to support the economy and the flow of credit to U.S. households and businesses. This, coupled with extraordinarily expansionary interest rates and positive corporate earnings (see next note), would continue to support the strong performance of risk assets.