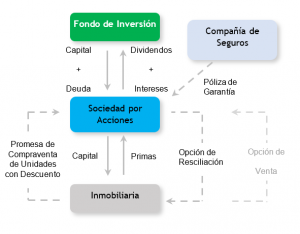

The private debt asset class called Preferred Equity is considered as the execution of promises of sale of saleable units of one or more real estate projects. The Preferred Capital asset class is considered as the execution of promises to purchase and sell sale of sale of saleable units of one or more real estate projects, with prepayment of the price, together with the execution of options to rescind such promises, by virtue of which the Fund's company and the real estate developer or owner of the assets, while committing to enter into the promised sales and purchases, acknowledge the possibility that such commitments may be terminated ("Project"). These transactions will be guaranteed by means of an insurance policy or a bank draft, in accordance with the provisions of Article 138 bis of the General Law of Urbanism and Construction.

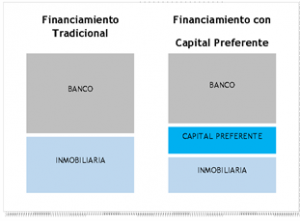

The financing structure is as follows:

It has the following guarantees:

The structure can be seen graphically below: