DiDi, the Chinese ride-hailing company, has initiated proceedings before the US stock exchange authorities to launch an initial public offering (IPO), which could be the largest this year in the US stock markets. DiDi plans to raise some US$10 billion with this IPO, which would put the company's market value at US$100 billion. Some 30% of the funds raised would be used to bolster the company's international expansion (DiDi is active in 15 countries, including Chile, but currently only a tenth of its revenues come from outside China) and another 30% to support the development of its electric and autonomous vehicle division. DiDi was created in 2012 and four years later acquired Uber's operations in China, ceding 12.8% ownership to the U.S. company. It has around 500 million users in 4,000 cities around the world. In 2020, DiDi reported revenues of US$22.2 billion, twice as much as Uber although, as noted by the Wall Street Journal, DiDi includes in its sales the revenues of its drivers.

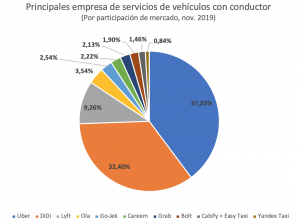

Source: Statista