As we have discussed in previous releases, our view is that 2022 will be the year of a full global recovery and the end of the global pandemic, thanks to the achievement of broad population immunity and new therapies. We believe this will produce a strong cyclical recovery, a return of global mobility and a release of pent-up demand from consumers (e.g., travel, services) and corporations (inventory recovery, capital investments and buybacks).

This macroeconomic environment is consistent with a normalization of monetary policy, especially in a context where inflationary pressures remain high.

Now, it is always good to ask what could go wrong, and here China's zero covid strategy and its impact on supply chains and the global economy appears as a potential risk to the baseline scenario.

While Omicron is much less deadly than other covid variants, it is still deadly enough to cause shortages of health care services in China, at least in some regions. Vaccination has proven ineffective in preventing the spread of Omicron, and while it offers protection against hospitalization, China still has about 20% of the population that is unvaccinated and will face serious health risks if Omicron becomes widespread.

Therefore, the fact that Omicron is already flooding much of the world economy and spreading across Asia, especially China, manufacturing disruption could be inevitable, temporary, but hugely disruptive nonetheless.

For those who have forgotten last year's global shockwave when China shut down its ports for several days, a quick reminder: it caused an unprecedented setback in global logistics and shipping that has not been resolved to this day. That's because China is the world's largest trading nation , and its ability to keep its factories running during the pandemic has been crucial to global supply chains.

The paradox of China's aggressive "Covid-zero" strategy is that while it helps contain the spread of the virus, doing so often requires significant disruptions or blockades as authorities limit the movement of people. Repeated mandatory testing in entire cities can disrupt business and production.

Therefore, how China's control of the virus plays out will ultimately be crucial. Those companies whose supply chains are entirely located within China may be isolated by the country's mitigation strategy.

So then, to the extent that the Chinese government attempts to contain the Omicron outbreak with more blockades and quarantines rather than adopting a "live with Covid" approach, this will pose downside risks to near-term growth. The impact on consumption could be significant, although probably not as large as what happened in 2020.

The effects of China's restrictions while the country maintains its zero covid policy "are beginning to affect supply chains in the region."

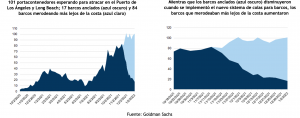

As a result of the slow movement of goods through some of the nation's busiest and most important ports, shippers are now diverting to Shanghai, causing the kinds of chain delays at the world's largest container port that led to massive congestion bottlenecks last summer, resulting in a record number of container ships waiting off the California coast, an excess that has not been eliminated to this day.

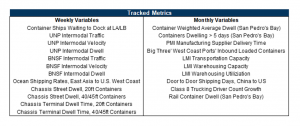

As Goldman Sachs records in its weekly U.S. supply chain congestion tracking report, containerships waiting to dock at the ports of Los Angeles and Long Beach increased from 97 to 101 in last week's report (17 ships at anchor, 84 ships even further offshore).

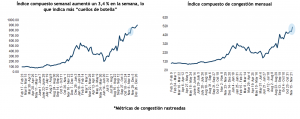

And overall congestion scale remains at the '10' or "fully congested" level, as the weekly index continues to reflect record highs in supply chain congestion levels.

Market and policy scopes

More importantly for the US, global capital markets and the monetary policy of the Federal Reserve, which has assumed much stronger growth in 2022, the Omicron outbreaks in China are downside risks to near-term consumer demand.

However, consumption is likely to recover quickly once the blockades are lifted. Similar to what happened before, these negative impacts are likely to be transitory and will be followed by a strong recovery once the blockades are lifted and businesses reopen.

Still, the economy and markets are not "immune" to supply chain stress and, as in 2021, the question will be how to offset rising costs (inflation), and the potential slowdown in growth and how this might affect the Fed's view of what the optimal policy response is. While the Fed's focus for now is clearly on containing inflation, the reality is that much of the inflation experienced today is on the supply side. In the meantime, if we see a "surprising" drop in growth in the coming months, the Fed will have no choice but to delay or at least stagger its tightening, as the last thing it can afford is to enter another recession.

Humberto Mora

Strategy and Investments FYNSA