The reflation trade, which occurred as the money supply increased and the U.S. economy moved toward a post-pandemic recovery, implies that investors are betting on a return of massive stimulus-driven inflation under President Joe Biden and a Democratic Congress. This dynamic has caused cyclically sensitive stocks to outperform defensive stocks and value stocks to outperform growth stocks, along with a rebound in commodity prices and rising long bond yields.

But after the Federal Reserve's last meeting on June 16 indicated the possibility of earlier-than-expected rate hikes, momentum in value stocks over growth stocks stalled, short-term government bond yields rose sharply and value and cyclical stocks plunged, the momentum of value stocks over growth stocks stalled, short-term government bond yields rose sharply, and value and cyclical stocks plunged.

Value stocks, which tend to have low price-to-earnings ratios but solid fundamentals, have rallied as much as 17.4% since the start of 2021 as the reflation trade took hold while vaccination numbers rose and COVID-19 deaths declined. Those stocks fell about 3.8% after the Fed meeting.

Meanwhile, high-growth tech stocks, which had rallied during the height of the pandemic but were outperformed by value stocks for most of this year, rallied about 1.7% after the Fed's forecast was released.

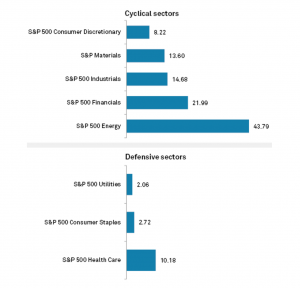

The reflation trade has also been a boon for cyclical stocks. reflation trade has also been a boon for cyclical stocks, particularly the consumer discretionary, industrials, materials, financials and energy sectors, which haveparticularly the consumer discretionary, industrials, materials, financials and energy sectors, which are up an average of 22.1% since the beginning of this year. Cyclical stocks tend to perform better during a booming economy and worse during a downturn.

By comparison, defensive stocks, including utilities, consumer staples and health care, are up just under 5% year-to-date. Defensive stocks tend to provide steady earnings and dividends even when the economy is in decline.

However, the strength of cyclical sectors has been tested by the Fed's possible initial push for higher rates. For example, the S&P 500 energy sector, which is up nearly 44% since the beginning of the year, plunged about 6.7% after the Fed meeting. Financial stocks, up as much as 30% since the beginning of 2021, fell 5.4% after the Fed meeting.

The Fed's more aggressive pivot probably triggered a short-term reversion to growth and mega-cap stocks, but the rotation may already be reversing and we continue to believe that cyclical stocks are the best place to be.

Otherwise, despite most Fed officials raising their forecasts for the timing of the next rate hikes, the Fed's ultra-loose monetary policy, which includes a continued commitment to near 0% interest rates and monthly purchases of $120 billion in Treasury bonds and mortgage-backed securities, remains in place. authority's ultra-loose monetary policy, which includes a continued commitment to near 0% interest rates and monthly purchases of $120 billion in Treasury bonds and mortgage-backed securities, remains in place. Instead, economic growth remains strong and some upside risks to inflation still persist, before tending to moderate by 2022.

After long outperforming growth stocks, value stocks have underperformed since the Fed's June meeting (%)

Since the beginning of 2021 cyclical stocks have outperformed defensive stocks

Source: S&P Globlal Market