In my more than 30 years of professional career in the financial industry, I have witnessed crises of different origins and nature. However, I must admit that I have rarely been faced with a scenario as uncertain and difficult to interpret as the one our country has been experiencing since the end of 2019. As a result of the events that occurred in October of that year and, the subsequent health and economic crisis caused by Covid 19, the Central Bank developed a measure of economic uncertainty in daily frequency, called "Twitter-Based Economic Policy Uncertainty Index for Chile". Based on information published in 15 official twitter accounts of the main television, written and radio news programs in the country, with a potential reach of 25.7M users, its purpose is to provide decision makers with an additional indicator to their usual monitoring tools. Undoubtedly, a necessary instrument considering the uncertainty associated with the pandemic and the process of institutional changes initiated by the country.

In an effort to better understand this scenario and the measures proposed by politicians to face it, I have carefully read the government programs of the pre-candidates of the two political blocs that in the next few days will measure their forces in the primary elections. At times it does not seem easy to understand how, faced with the same problem, it is possible to find radically different solutions, depending on the ideological commitment of the party or movement that supports that candidacy. However, I have been particularly struck by the tax proposals contained in some of these programs.

With an apparent lack of knowledge of our tax system, there is talk of comparatively low and insufficient tax collection, unfairly distributed tax burden and other concepts that reflect an ideological bias in the diagnosis and proposals.

Any proposal to modify the current tax system must consider the respect of certain essential principles, such as tax legality, equality or equity of taxes, non-confiscatory nature of taxes, simplicity that favors tax collection and sufficiency to provide the necessary resources to finance public spending.

The candidates state their intention to increase tax collection by 5% to 10% of the GDP or rather by 25% to 50% in addition to what we collect today. The question then inevitably arises: what taxes are to be increased, in what amounts, or what new economic activities are to be taxed?

The cold numbers indicate that our country's tax collection is equivalent to 20.7% of GDP, while the average for OECD countries is 33.8% (GDP), including in this percentage the amount collected from VAT, VAT and other taxes. VAT collection, personal taxes, contributions, y social security. Seen in this light, to any impartial reader it may seem that there is still room to reduce the tax gap that apparently exists with the countries with which we compare ourselves.

However, this assessment is not completely true, among other reasons, because in OECD countries social security is a pay-as-you-go system (9.2% of GDP), with the contribution of individuals to the system being greater than in our individually funded model (1.5% of GDP in Chile).

For the same reason, and before making this type of comparisons, I consider it necessary to make some clarifications on the information used for these calculations. Thus, for example, if we exclude, in the case of Chile, individual capitalization and, in the case of the OECD, pay-as-you-go, since these cannot be compared, the figures indicate that our country has a collection of 19.6% (GGP) and the OECD 25.1% (GGP) on average, which is, by the way, very far from the percentages and numbers contained in these programs.

It is therefore interesting to review in detail the taxes we pay in Chile and see if there is indeed room for improvement in tax collection.

From a simple reading of the official data, we can conclude that in terms of VAT Chile is in the average, however, well above the average in the case of corporate taxes.

There is an important gap in the collection of personal income tax. Chile collects for this concept the equivalent of 1.4% of the GDP while the average of the OECD countries represents 8.3% of the GDP. How can this gap be explained?

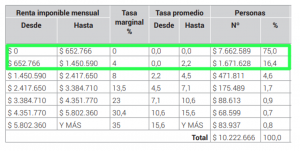

There are two facts that call our attention and help to understand the low collection of this tax: one is the extension of the exempt bracket, which is equivalent to 75% of the potential taxpayers, and the other is the origin of the collection, 60% of which comes from people located in the higher brackets of the tax table.

Considering the current political scenario and climate, it seems unrealistic to think about reducing the extension of the exempt bracket and taxing lower-income people who do not feel satisfied with the services provided by the State, in areas such as housing, health and education, among others.

In an election year, it is not surprising that the issue of our tax system is once again gaining prominence. Considering the proposals in this area and a long list of "social rights" that there is consensus in guaranteeing, it seems evident that the country will be faced with greater budgetary pressures, as a result of the need to finance these demands. The candidates' programs include a series of proposals that are not very novel and whose implementation may have unexpected effects. In this line, there is talk of an increase in the mining royalty, capital gains tax, taxes on foodstuffs harmful to health, elimination of exemptions and others, whose fairness, efficiency, simplicity and sufficiency will have to be evaluated.

However, in this discussion it seems prudent not to forget that we are part of a global, competitive world, where countries compete to attract new capital and investors are free to make the decisions that are most convenient for them. In this tense atmosphere that the country is experiencing, dominated at times by slogans and slogans, it seems prudent to reflect calmly on this and other issues of special importance for the country we want to build.

Francisco Muñoz

Partner - Commercial Director FYNSA