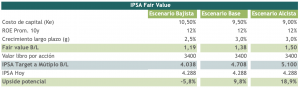

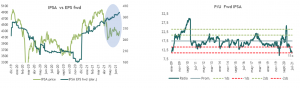

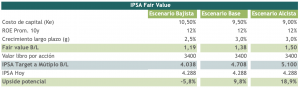

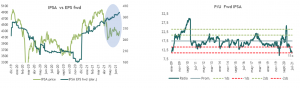

Our scenario considers an IPSA target of 4,700 points. We base our projections on a relatively conservative scenario in terms of valuations, understanding that the local scenario would continue to be challenging given the ongoing constitutional process and next November's presidential election, but that given the magnitude and timing of monetary and fiscal stimulus, already fairly discounted valuations and a favorable international scenario (including the recovery of key commodity prices), it would offset part of the domestic political electoral risks.

Looking ahead to the remainder of 2021 and incorporating the new information available, there is reason to be a little more optimistic (or if you prefer "less pessimistic").

- Although we recognize that some factors of uncertainty will still be present, after the results of the presidential primaries last weekend, where the most extreme speeches were defeated and the ideas of defending institutions tend to prevail, we believe that there is some space to focus more on the economic reactivation, the commercial reopening and the improvement in the companies' profits. Thus, we could have a couple of months a little calmer (prior to the presidential elections) that would allow the IPSA to revert part of the strong punishment incorporated in the valuations, because the political punishment will diminish in the margin and it will be able to move more on the fundamentals.

- The external scenario will continue to be favorable, with copper prices continuing to rise, greater global liquidity and a highly expansive fiscal policy that is intensive in raw materials, are important indicators that could generate greater capital gains in the local stock market.

- In terms of health, with more than 2/3 of the population fully vaccinated and the progress of the Step by Step plan, the economic reopening has been gaining strength. So far the country enjoys a privileged position in the availability of vaccines thanks to the government's efforts, which has been an example for the rest of the countries in the region and even for several developed countries. This will logically help the speed of recovery of our economy.

- All this leads us to believe that on the one hand we could have a better than expected recovery scenario for company earnings and that on the other hand there would be room for some expansion of multiples.

In terms of strategy, we favor stocks that we find undervalued (value), of quality (solid financial position), and growth potential. Sectorally we are favoring commodities, banks, retail and real estate.

- The favorable trends in the commodity sector are expected to continue going forward, where the combined fiscal and monetary stimulus, which far exceeds the effort made for the financial crisis, coupled with greater stability in the Chinese economy, are tailwinds for the sector's demand, which added to the expected weakness of the dollar and some Covid-19 related supply shocks, would support further price recoveries.

- We believe that sectors such as retail - shopping - banks, would benefit the most from the fiscal impulse through government bonds and ample consumer liquidity, added to the economic reopening given the advances in the vaccination process.

If you want to see more details of this note click here: Local Equities