Undoubtedly 2021 has been a good year for risk assets, but also a very uneven year in terms of regional performance. While U.S. equities have returned 25%, markets such as Europe and Japan within developed markets have underperformed +10% and +1.49%, respectively. Not to mention the poor performance of emerging markets (-4.35%) affected by the financial and regulatory crackdown in China and a slowing economy.

What is striking in this dynamic is that while earnings growth for U.S. companies is on track for a solid +45% in 2021, markets such as Europe and Japan exceed this by +65% and 48% respectively. Even emerging markets would show earnings growth of close to 60% in 2021. In other words, ex-US markets have been affected by an "understanding of multiples" rather than because corporate dynamics have disappointed.

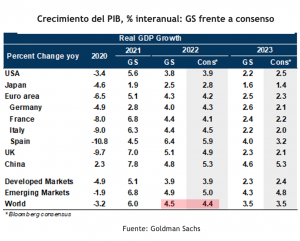

The fact that the S&P 500 is leading stock returns can basically be explained by a U.S. economy that has proven to be a reliable source of growth. It has emerged from the pandemic stronger than anywhere else given highly expansionary monetary and especially fiscal policy, while elsewhere things are slower. China's GDP growth has slowed and in Europe, a wave of covid-19 infections has led to some restrictions on business activities.

The question then becomes, will this dynamic continue in 2022?

An important part of the answer has to do with the development of the Pandemic. Last week we argued about the emergence of the Omicron variant, that its potential effects were probably overstated, that while Omicron is likely to be more transmissible, early reports suggest that it may also be less deadly, which would fit the pattern of virus evolution observed historically. Should these trends be confirmed, could the Omicron variant ultimately prove positive for risk markets, in that it could hasten the end of the pandemic? If a less severe and more transmissible virus quickly displaces the more severe variants, could the Omicron variant be a catalyst for transforming a deadly pandemic into something more like seasonal flu? Such a development would fit with historical patterns (duration and number of waves) of previous respiratory virus pandemics, especially given the widespread availability of vaccines and new therapies that are expected to work across all known variants (Pfizer, Merck).

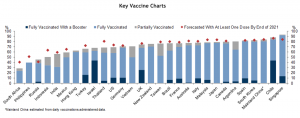

We are inclined that by 2022 the pandemic will be further in retreat, supported also by high vaccination rates that should gain in depth and regional distribution, which should allow the global growth gap to narrow. As we noted, the U.S. economy has more than recovered, but other countries still have ground to make up and will eventually do so. Much of Asia's sluggishness is attributed to the slowdown in China and not enough to the lingering effects of the pandemic in the region. In this regard the fact that at the recent Poliburto meeting, China adopted language supporting the economy and the real estate sector seems to us to be the first step in reversing this trend in 2022. Meanwhile Europe has never fully reopened and there is fiscal stimulus from the EU recovery fund in the pipeline. The U.S. could still lead, but the race will be tighter.

From a tactical standpoint, we are bullish on stocks, given strong economic growth, solid earnings and low bond yields.

Global economic growth is likely to remain above trend in 2022 and we believe Eurozone and Japanese equities, U.S. mid-cap stocks, the global financial sector, commodities and energy stocks will benefit from this.

By 2022, we forecast global corporate earnings growth of 10%. Within this forecast, we believe cyclical stocks will post the highest rates of earnings growth, given their greater sensitivity to economic growth. In particular, we like the eurozone and Japanese equity markets, the global financial sector and U.S. mid-cap companies. We also favor commodities and energy stocks, which will also benefit in the event of more persistent inflation than in our baseline scenario.

For Japanese equities, we expect further easing of restrictions by COVID-19 to boost both economic growth and investor confidence in Japan. The government of the new prime minister, Fumio Kishida, is expected to push through a fiscal spending package of approximately 4% to 5% of GDP. Monetary policy is also likely to remain relatively expansionary and contribute to further yen weakness. The TOPIX index trades at 14 times 12-month expected earnings, making it cheap relative to the 18.6 times and 21.1 times multiples of the MSCI All Country World Index (ACWI) and the S&P 500, respectively.

After underperforming US equities every year for the past decade, eurozone equities are one of our preferred markets for 2022. The eurozone market is cyclical, so it stands to benefit from the resolution of supply chain difficulties and inventory replenishment. Current investor positioning towards the region is light (only 3% of equity positions are in MSCI EMU equities, compared to the eurozone's 9% weighting in the MSCI ACWI index). In the coming months, eurozone equities should be supported by expansionary monetary and fiscal policy and strong GDP and corporate earnings growth.

The global financial sector has historically performed well when yields have risen slightly. We expect 10-year U.S. Treasury yields to reach levels closer to 2% in 2022. Fundamentally, we believe financial sector returns should be helped by higher loan growth and credit quality, as well as the release of loan loss provisions.

We expect commodity prices to stabilize in 2022. But many commodity-linked stocks have not yet discounted a prolonged period of high prices. For example, energy stocks are estimated to only continue to factor in a long-term Brent crude oil price of USD 60/barrel.

We also see value in industrial metals, particularly copper, which are likely to benefit from the transition to zero net carbon emissions. This could encourage a more active approach to commodity allocation, which in turn would offer investors a hedge in case commodity supply problems lead to more persistent inflation.

Investment downturn

Humberto Mora

Strategy and Investments FYNSA