We reiterate our call that markets are likely to experience continued significant internal rotation towards year-end, driven by a rally in bond yields and at the end of the flattening of the yield curve. Many are concerned about the sustainability of the rotation, as the growth outlook is seen as mixed at best, and the rotation is unlikely to persist if we get an energy / inflation / Fed shock, which would ultimately depress growth and generate a rollover in yields.

In our base case we will continue to have higher inflation, but also higher growth. We note that while inflation surprises remain on the upside, economic surprises also seem to have found a floor, which is most evident in the case of the US, but we expect the same for the Eurozone and China.

We believe that the growth headwinds that were present over the last few months, the slowdown in China, the resurgence of COVID cases associated with the Delta variant, a loss of consumer confidence and the slowdown in employment are diminishing, therefore, from current CESI (economic surprises) levels, we are likely to see a rebound towards the end of the year.

So then, we believe the driver of the rotation will be rising bond yields. U.S. bond yields have risen more than 40 basis points since the August low and we believe there is more downside ahead, expecting some of the gap between inflation breakeven and bond yields to begin to close.

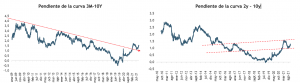

And not only are yields rising, but the slope of the yield curve has also steepened.

Which sectors benefit in this context? In general, the most "value" sectors that are used more directly as inflation hedges (energy sector) and commodities in general, but also the financial sector given the steepening of the curve. In addition, the financial sector is largely beating 3Q21 earnings estimates with positive surprises of +2.8% in sales and +21% in profits, and relative valuations with respect to the general market remain quite attractive.

Investment downturn

Humberto Mora

Strategy and Investments