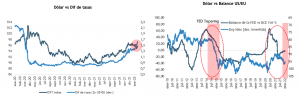

After rising for much of 2021, the dollar has stagnated, even had a sharp drop in the first weeks of this year (partly reversed in the current week), this despite the rise in US sovereign yields and that rate differentials continue to favor the dollar, at least against benchmarks such as the Euro.

Of course there may be some reasons for this phenomenon. In particular, the rotation that we have been seeing in the stock markets, also due to the higher interest rate pressures, from growth sectors (mainly technology, to value sectors) and which has not only been sectorial, but also regional, may be affecting the performance of the dollar, since the weight of growth sectors in the American stock market makes it more exposed to rate adjustments and in practice to an inferior performance than the rest of the markets.

Emerging currencies, heavily punished in 2021, are supported by higher commodity prices and China's policy shift to counter growth risks.

However, we doubt that these trends can obviate a more aggressive turn by the Fed. At this point it is clear that the Fed will have to move faster, but without necessarily becoming restrictive, or risk its "dovish stance" leaving it behind the curve, having to normalize even faster and self-inflicting a recession.

Contrary to the more consensus view, we believe that inflation is not near the "peak" and will not decelerate soon, as pressures, mainly on the supply side, will remain high and may still take several quarters before improving, in a context of highly stressed supply chains and higher energy prices. Add in today's higher wage inflation in the US and the cocktail is dangerous.

In practice, the market today already incorporates 4 rate hikes for this year, with the first one already advanced for the March meeting and the balance sheet reduction discussion likely to pick up steam starting at next week's FOMC meeting. Jerome Powell, himself, has suggested that the FOMC wants to move policy to a neutral or even tightening environment more broadly. The recent suggestion that "quantitative tightening" will begin earlier and move faster than in the previous tightening cycle is an indication in that direction.

And on the other hand, it is highly unlikely that other developed market central banks will raise their policy rates as much or as fast as the Fed is expected to. If that is correct, interest rate differentials would move further in favor of the dollar.

Therefore, wider rate differentials and anticipated balance sheet reduction should support a resumption of the global dollar uptrend.

After a terrible 2021 for the peso (among the worst performers), the Chilean peso has been the best performing emerging market currency this year, having risen around 7% against the dollar.

This is taking place in a context where the perceived "moderation" of President-elect Gabriel Boric has mainly seduced foreign investors, who have substantially increased their bets in favor of the peso in recent weeks, in search of the attractive carry trade offered by local rates today.

Of course, since the rumor began to circulate at the beginning of this week (now confirmed) that Mario Marcel could be the Minister of Finance, the peso's appreciation trend has been accentuated. It makes sense, Marcel's appointment is a powerful signal to the market as he is a respected economist, with a lot of experience to assume the portfolio, recently decorated by several institutions as "best central banker of the year", who is positioned "at the center" and with the necessary political experience to be able to manage and negotiate the spending policies of the coming years while limiting the risks related to fiscal responsibility.

Having said all that and to be consistent with the first part of the note, how likely is it that the appreciation trend for the peso will persist, or will it end up being the classic "buy on the rumor and sell on the news"?

We believe it is unlikely that the rally can be extended in the short term. After a drop of 60 pesos so far this year, the peso is already an overbought currency, global trends will continue to favor the dollar and also because even though some call Mario Marcel "super Mario", he "can't do miracles" either.

Even with a Finance Minister like Marcel, fiscal risks will persist for the time being (remember that Boric's program is very intensive in public spending) and fiscal consolidation also depends on a rather ambitious tax reform.

And let us not forget that the constituent process is still underway, which among other things aims to entrench much greater state intervention in the economy.

All in all, whether you are a speculator or want to continue diversifying your investments in terms of currency, the current exchange rate levels (below $800) seem attractive for dollar purchases ahead of a particularly challenging first part of 2022, both domestically and externally.

Humberto Mora

Strategy and Investments