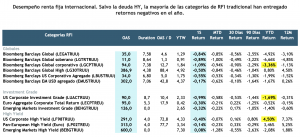

This year marks the first time in nearly a decade that bond investors have earned significant negative returns. In part, the massive sell-off in bonds was the result of fading coronavirus risks and a solid economic recovery, and in part the consequence of elevated inflation risk and the possible removal of highly accommodative monetary policy. In principle our forecasts for the coming year imply that yields especially on longer durations are likely to turn negative again.

With the pandemic largely behind us, interest rate markets next year will likely be driven by inflation outcomes and how central banks choose to respond. These considerations will need to be evaluated along with diminishing labor market slack, which, all else equal, implies higher equilibrium yield levels.

While we do not expect very aggressive rate hikes next year from the major DM central banks (particularly the Fed and ECB), high inflation and strong growth will likely allow markets to anticipate this exit, and yields should rise. Therefore, yields are likely to remain a source of bearish impulses for sovereign bond markets, as they were in the second half of this year.

Against this backdrop, let's go to the strategy

When structuring a fixed income strategy there are key variables to consider: credit risk and spread levels, interest rate trajectory and duration risk and liquidity.

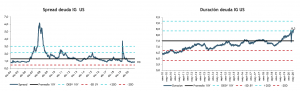

The current context is particularly challenging for an RFI portfolio and more conservative risk profiles. Interest rates are at historic lows (therefore, rate risk is asymmetric) and IG fixed income duration is at highs in excess of 8 years (therefore, duration risk is very high) and corporate spreads at near historic lows (which offer little cushion to protect against rate hikes).

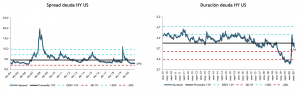

In particular we do not see much spread risk going forward given the positive macro environment, positive corporate outlook and higher risk appetite, therefore holding exposure in high yield (HY) debt remains a good alternative, given also its short duration. EM debt may be an alternative, but with considerably higher risk, given the outlook for deteriorating macro financial conditions in China and higher inflation risks.

We also believe that the low yield outlook will continue to stimulate appetite for illiquid segments, such as private debt markets, as well as for more complex instruments, such as structured products.

Investment downturn

But what to do if I don't want to sacrifice liquidity and don't want to be exposed to the higher volatility of HY and EM debt?

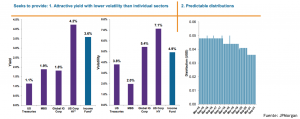

Fortunately, today there are active, globally diversified, flexible strategies on the market in terms of duration, which seek the maximum possible income with a limited level of risk and which seek to pay income in predictable dividends.

Simply put, they offer attractive returns with lower volatility than individual sectors and predictable distributions.

These strategies basically invest in all fixed income classes. They have government, credit (IG and HY), EMD and securitized debt, but liquid and very short term, which is what allows for predictable coupons, in addition to being floating rate debt.

Within this universe of strategies, we highlight 2 funds:

PIMCO GIS Income Fund and JPM Income fund

The first is a strategy that has met its objectives for more than a decade: that is, to seek value in the global fixed income market while balancing yield with capital preservation objectives.

The fund currently has a duration of 1.6 years and a YTM of 3.6% and accumulated a return of 1.42% for the year (at the end of October), 6% in 12 months and an annualized return of 5.3% in 3 years.

The second strategy uses an investment process driven by a globally integrated research process that focuses on analyzing fundamental, quantitative and technical factors across countries, sectors and issuers.

The fund currently has a duration of 1.2 years and a YTM of 3.6% and accumulated a return of 2.8% for the year (at the end of October), 6% in 12 months and an annualized return of 5.5% in 3 years.

Humberto Mora

Strategy and Investments