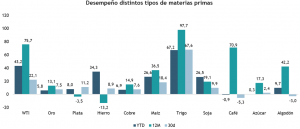

Last week we recommended adding exposure to commodities, as the geopolitical escalation has significantly increased the risk of further aggravating the energy and commodity crisis that developed over the past two years. Potential disruptions to trade in oil, gas, grains and metals now represent a significant risk to investments and the real economy. Investors should therefore hedge this risk by increasing allocations to commodities, energy and materials. These allocations would serve as a hedge for inflation and geopolitical risks.

Well, this week we want to reaffirm our view of the advantages of adding commodities to a portfolio in the current environment and further elaborate on this investment thesis. From a strategic perspective, commodities are not only a geopolitical hedge, they are also a hedge against inflation and against the valuation risk of the change in the reaction function of Central Banks.

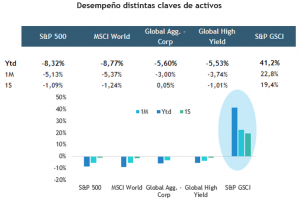

And the diversification argument has rarely been stronger with commodities up 40% ytd, half of that over the last week (as measured by the S&P GSCI Commodity index) and stocks down 8% (as measured by the S&P 500).

The investment case for commodities has rarely been stronger and the rising geopolitical tensions surrounding Ukraine have only strengthened commodity visibility. While the market is still working with a base case of limited disruption to food and energy flows, (under the assumption that none of the governments' economic interests have the use of food or fuel as a tool to pressure Russia), almost all major commodity markets are in a state of severe depletion, thus highly vulnerable to even the smallest shocks. Moreover, each disruption increases the likelihood of another revolt, with shortages in one market causing insolvency in another as we have been seeing, for example, in the European gas and aluminum markets.

While many commodities are fundamentally exposed to events in Ukraine, it is oil and Gold that provide the cleanest hedges for this geopolitical risk. Firstly, there is a clear upside bias in oil prices, both tactically and strategically, with any geopolitical risk premium exceeding the tightest inventory levels in decades, low spare capacity and a much less elastic shale sector. According to Goldman Sachs estimates, if the oil market is forced to balance by 2022, a year ahead of its US$105/bbl price base case, the oil price will have to reach US$125/bbl to balance almost entirely through demand destruction. The key point of relief for a bullish setup in oil would be a deal with Iran, however, the geopolitical hurdles for this appear to be stubbornly high.

In the same vein, it is clear that as geopolitical tension increases, Gold is acting as a currency of last resort, as Gold tends to respond to those geopolitical risks that can directly affect the US. So, then, the current energy crisis and above-target US inflation mean that any disruption in commodity flows from Russia may generate greater concern about an overshoot in US inflation and a subsequent hard landing.

Currently, in our sector strategies, we are recommending exposure to commodities through 2 channels

- In the U.S. energy sector through the Energy Select Sector SPDR Fund ETF (XLE).

- In the mining sector through the iShares MSCI Global Metals & Mining Producers ETF (PICK).

- Looking for a more direct alternative commodity exposure? A good option is through the iShares S&P GSCI Commodity-Indexed Trust (GSG) ETF, which has, among its largest exposures, 60% in energy, 18% in agriculture, 11% in industrial metals and 4% in precious metals.

- For direct exposure to Gold, an alternative is the SPDR Gold Shares ETF (GLD).