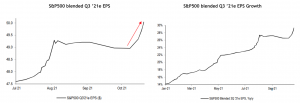

We are approaching the busiest part of the third quarter earnings season, with nearly 50% of U.S. companies scheduled to report next week. So far, only 21% of US companies have reported. While it may still seem too early to make a meaningful assessment, initial results point to better than expected earnings growth, with Q3 EPS growth of +44% y/y and it is encouraging that the combined S&P500 Q3 EPS is starting to trend higher.

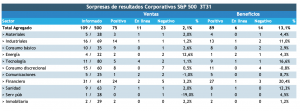

86% of the S&P500 companies reporting beat EPS estimates. EPS growth for these companies is +44% year-over-year, surprising positively at 13%. Materials and Discretionary are posting the strongest growth among the sectors, with the caveat that very few companies have reported to date, in both cases. Top line growth is coming in at +16% y-o-y, surprisingly positively at 2%.

On the top line, 69% of companies are exceeding sales estimates. Overall revenue growth is +16% year-over-year. All sectors excluding utilities are experiencing positive revenue growth.

Combined 3Q21 EPS for the S&P500 increased to US$50 (+29% y-o-y), up from +14% y-o-y at the beginning of the year.

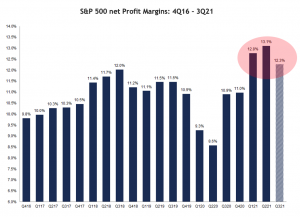

Another point to note given the concerns in the market about rising inflation is that the S&P 500 is reporting the third highest net margin since 2008 for the third quarter and is above the prior year's net profit margin and above the five-year average of 10.9%.

We believe that these performance trends in no way account for concerns about a slowdown in economic growth and for the time being higher inflation is being well absorbed.

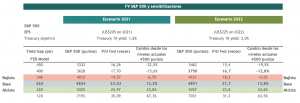

Finally, we expect Q3 earnings season to support risk assets over the next few weeks and beyond. Buying market adjustments has continued to be an effective strategy and now that we are about to break above all-time highs, targets in the 4,800 - 5,000 range for the S&P 500 seem to us the most likely path .

Financial conditions otherwise remain at very expansionary levels and will continue to be so despite an expected tightening of monetary policy. Inflationary strength is putting pressure on central banks to unwind ultra-accommodative policies, not only because inflation has risen uncomfortably above their targets, but also because inflation depresses real policy rates, making current monetary policy even more accommodative than the nominal policy rate suggests.

However, as long as real yields remain contained, they should not exert major pressure on market valuations, which in any case remain quite favorable relative to interest rate levels.

Humberto Mora

Strategy and Investments