The FOMC left the funds rate target range unchanged at 0-0.25%. The Committee acknowledged that the "further substantial progress" test for tapering has been met and announced that it will begin tapering monthly increases in its holdings of agency and Treasury MBS beginning in mid-November. The Committee specified a $15 bn reduction in asset purchases in November and December ($10 bn in Treasury and $5 bn in agency MBS holdings), and felt that the $15 bn per month pace "would likely be appropriate," but that it is "prepared to adjust the pace of purchases if changes in the economic outlook warrant." Assuming the FOMC does not pause or change the pace of tapering, the final tapering would be announced at the May 2022 FOMC meeting and the last one would be implemented in mid-June 2022, probably a couple of days before the June meeting.

The statement's characterization of the current economic situation continued to emphasize the impact of COVID-19 on economic activity, but was updated to acknowledge that virus cases have slowed since the summer.

Inflation was again characterized as "elevated," but the assessment "largely reflecting transitory factors" was diluted to "largely reflecting factors expected to be transitory," and the statement noted that pandemic-specific supply-demand imbalances and reopening effects have contributed to higher prices.

In addition, the Committee updated the statement to acknowledge that the easing of supply constraints, as well as progress on vaccines, are "expected to support" continued economic gains and a reduction in inflation, but that risks to the outlook "remain."

The question that follows is why the much feared "tapering" has not generated greater volatility in assets and we are ending another record week in equities?

A few weeks ago we noted that investors should note that the Fed is moving forward because it has more confidence in the economy and will continue to provide support. While higher bond yields reduce the relative attractiveness of stocks, a gradual rise in bond yields should be more than offset by the positive impact of rising corporate earnings as economies return to normal and that, therefore, Fed tapering should be viewed as the gradual withdrawal of an emergency support measure as conditions normalize.

In this regard, a key point that seems to us is to continue to make the distinction between reducing asset purchases and rate hikes. Today, interest rates in real terms are still extremely expansionary, even more so considering the "higher tolerance" for higher inflation, which makes the Fed's current monetary policy even more accommodative than the nominal policy rate suggests.

In our base case we will continue to have higher inflation, but also higher growth (something reaffirmed in this week's Fed statement). In this regard we believe the correct approach is to continue to overweight equities over fixed income, where relative valuations continue to offer ample reward for their history and equities are the only asset class that produces positive real returns and tend to perform well in a higher inflation regime.

We also highlight:

Economic data is improving. The week culminates with a solid US job creation data (531,000 jobs were created, well above the consensus experience of 450,000), a report that is more consistent with what is happening in an economy that remains solid and is growing well.

The 3Q21 corporate earnings season is wrapping up with solid results, with 81% of S&P500 companies reporting beating EPS estimates. EPS growth for these companies stands at +41% y/y, which surprises positively at 10% , and the future outlook remains favorable. (The proportion of companies making upward revisions to their EPS guidance is approaching decade highs).

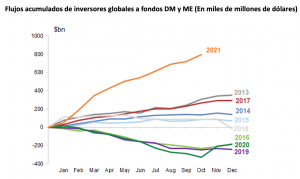

Equity inflows continue to be strong. Equity inflows this week totaled US$26.1B and already exceed US$800bn in 2021.

Humberto Mora

Strategy and Investments Fynsa