Since September 14, the nominal yield on 10-year U.S. Treasuries has increased by 26 bps (1.28% to 1.55%) and the real yield on 10-year U.S. Treasuries has increased by 20 bps (-1.05% to -0.85%).

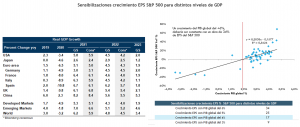

Now, rate moves so far are less dramatic than in early 2021, but the economic backdrop is less favorable for stocks today. In general, stocks have struggled when higher real rates were driven by perceived changes in Fed policy (e.g., "taper tantrum" in 2013, "long way from neutral" in 2018) and performed better during periods of improving growth (e.g., after the 2016 Election, passage of tax reform in late 2017). The real yield on 10-year U.S. Treasuries rose 50 bps between late February and mid-March, a move of about 3 standard deviations. However, that move largely reflected the continued improvement in the outlook for economic growth following the vaccine announcements in early November. Today, economic growth is slowing, and the Fed is expected to announce the start of tapering at its November meeting.

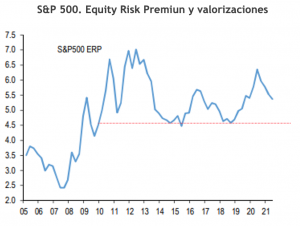

So the question that follows is ... Is a hawkish Fed a problem for equity markets? One transmission channel through which a more aggressive Fed could hurt stocks is through a rise in real rates, as higher real yields reduce the relative valuation advantage of stocks versus bonds. However, we continue to have difficulty characterizing stocks as expensive when real yields remain so negative, with the 10-year real UST at -88 bps. This level of real yields implies an equity risk premium of around 5.3% currently for the S&P 500. In the prior correction of 2015 and 2018, the equity risk premium bottomed at 4.5%. So, mechanically, we would need to see the 10-year real yield rise by 80 basis points from here for equity risk premiums to decline to 4.5%.

We continue to believe that the speed and composition of rate movements will be more important to stocks in the near term than the level of rates themselves. Equities remain attractively valued relative to the level of interest rates. Using a multiple the P/U of 20x for and a 10-year UST yield of 1.5%, the earnings yield gap between stocks (4.9%) and bonds equals 345 bps, ranking only in the 39th percentile compared to history. Without any change in P/U, the 10-year UST yield would need to rise above 2.3% for relative equity valuations to move above the long-term average.

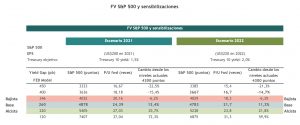

With these variables we are able to project the potential for equities going forward. Barring any major negative surprises, we believe that the most fair value levels for the S&P 500 would be between 11% and 13% from current levels with downside risk limited to 6% (for which we assign a low probability of occurrence), so that recent adjustments would still qualify as a "Buy the Dips" .

Our baseline scenario considers that prime rates would end the year around current levels (with some upside risk), although by 2022 higher interest rates should start to be considered in a context of higher inflationary pressures, but also because we expect a reacceleration of global growth.

For the time being we preferred to be conservative with 2022 earnings estimates with an expected EPS of US$220 (+10%) for the S&P 500 (around market consensus), although preliminarily we believe there is an upside risk considering that 2022 growth expectations both globally and for the US itself, would still be above potential and barring runaway inflation, earnings growth could well exceed expectations.