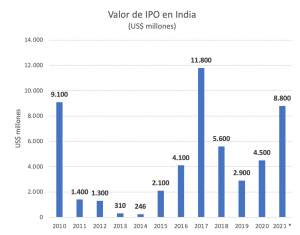

India is on track to break its record for raising capital through initial public offerings (IPOs). As of August 18, according to Bloomberg, US$8.8 billion had been raised in the Asian country, compared to US$11.8 billion raised in all of 2017, when the record was set.

The successful IPO of Zoomato, a delivery company, was delivery company delivery company that went public in July and whose shares had accumulated a 70% gain by mid-August, is one of the catalysts for the boom. That, along with Chinese government regulations on Chinese technology companies, has driven international investors into the Indian market.

Several startups, such as transportation app Ola, hotel booking company Oyo and fintech Pine Labs are preparing their documents to offer their shares this year, as are established companies such as Flipkart -an e-commerce firm controlled by WalMart-and Paytm, the country's largest digital payments company, which has already filed paperwork for its IPO with which it hopes to raise US$2.2 billion.

The IPO fever in India runs in parallel with a growing interest from venture capital funds in the venture capital in Indian start-ups. In July, VC investments in India totaled US$7.9 billion, surpassing China for the first time.