The current market condition coupled with the convictions that investment opportunities are constantly being generated, FYNSA is in the process of structuring a new investment initiative. The FYNSA Real Estate Debt Fund is a short term investment, through leveraged and leveraged structures. that can have leverage and real estate assets as collateral, also highlighting insurance policies for some structures that require it, generating an investment safeguarded with strong collateral such as real estate guarantees.

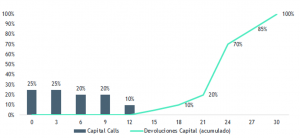

Currently, Chile is in a process of political uncertainty due to the sum of elections that generate volatility in the markets, therefore, a portfolio of private structures that has low correlation with traditional assets appears as an attractive initiative. On the other hand, the rise in construction costs due to the pandemic effect, the rigidity of bank financing due to Basel III and the economic crisis we have been going through recently, strengthen the investment opportunity in this type of alternative assets, whose guarantees have the lowest risk of default and present a return on investment that is higher than that of traditional assets. attractive return, reaching a target IRR of 10% nominal net of commissions, financing, taxes and other expenses, as well as liquidity in the short term, delivering cash flows to the contributor as of month 13 on a quarterly basis. The target size of this fund is UF 500,000 for a term of 30 months term, with an investment period of 12 months, delivering significant premiums over traditional fixed income of equivalent terms.