During March 2022 Fynsa AGF will launch the new "Venture Debt Latam" Fund, which aims to raise US$50,000,000, with the objective of investing in assets located in different Latin American countries, starting with Mexico, Colombia, Peru and Chile; expecting to have an annual return of 8% in dollars.

In recent times, we have heard a lot about topics such as: venture capital, startups, Fintechs, unicorns, Venture Debt, among other terms that can be heard day by day among people and the globalized world in which we live, but what is really Venture Debt?

When startups, emerging companies that have great growth potential, seek financing, they do so in two ways: the first is through equity or direct investment, which through angel investors, series A or other mechanisms, raise money against the company's participation. The second way is through debt, which could be granted by traditional banks, but due to the risk of the guarantees involved and the stage in which these companies are, banks are not able to cover the total demand for loans to startups, generating a business opportunity, which we will call Venture Debt.

In other words, Venture Debt consists of providing access to financing to these companies that are in an early stage of development and have growth potential. This financing is provided through the acquisition of assets originated by these companies, which allows them to have the resources to continue providing financing to individuals and/or SMEs.

In FYNSA we are pioneers in this strategy, where in early 2021 we launched the Venture Debt fund together with the Fintech MIGRANTE. This fund already has assets of more than 25 million dollars, in more than 12,000 loans, allowing us to provide financing to immigrants who are outside the financial system (they do not have access to credit), giving them opportunities to continue their personal development in Chile.

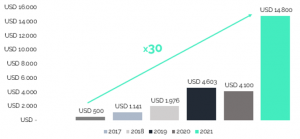

Over the last few years there has been a boom in the venture capital industry in Latin America, where in 2021 alone more than $14.8 billion was invested in venture capital firms, which translates into a 30-fold growth over what was invested in 2017.

In terms of success stories, these have also grown in line with the increase in investments, which shows that by providing these "ideas" with greater sources of financing, they are given more tools and opportunities to develop them and achieve success. In the region alone there are more than 40 unicorns, of which 18 were created during the year 2021.

This new FYNSA Venture Debt Latam Fund is presented as an attractive and contingent investment opportunity, where taking advantage of the current moment in the venture capital industry, the boom of new ventures and FYNSA's experience as pioneers in Venture Debt funds, it is possible to access an alternative that offers good risk-adjusted returns, allows portfolio diversification and provides opportunities for potential future innovative companies in the current economic ecosystem.

#PioneersInVentureDebt