Over the last decade, the Private Debt Alternative Asset class has been one of the fastest growing asset classes within the mutual fund industry.. This can be explained by the greater restriction adopted by traditional financial institutions after the 2008 financial crisis, which created a space for fund managers to enter the market to bridge the gap between the demand and supply of access to financing by private companies.

It is important to understand that the objective of Private Debt funds is to invest in financing instruments or contracts for private companies. Among the main underlying assets in which these funds invest are Mortgage Mutuals, Credits with SGR, Invoices, Direct Credits, Preferred Capital, Promissory Notes, Leasing, among others. It should be noted that this type of investment has a medium-long term strategy, obtaining liquidity premiums in their rates.

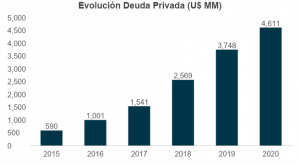

After years of being one of the asset classes with the highest annual growth, Private Debt had three complicated quarters, where the uncertainty caused by both the October 2019 crisis and the pandemic led to a drop in assets under management at the end of September 2020 compared to the assets under management at the beginning of the year.

However, the scenario of low rates of investment alternatives both at national and global level and the greater mobility and improvement in expectations in the last quarter of the year, generated a recovery in the appetite of investors to allocate more assets in Private Debt assets, which generate an adequate risk/return ratio, generating better diversification and higher spreads against market alternatives.These assets generate an adequate risk/return ratio, generating better diversification and higher spreads compared to market alternatives.

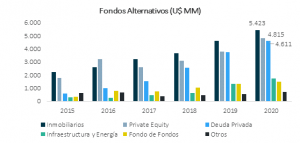

According to ACAFI data, at the end of 2020 there were 107 Public Private Debt Funds with assets under management of U$4,611 million. Since 2015, assets under management in millions of dollars in Private Debt in Chile have increased by 682% and with respect to the close of 2019 grew by 23%, being the third alternative asset with the highest allocation in the industry, behind Real Estate Assets and Private Equity.

FYNSA AGF currently manages 4 Private Debt funds with approximately U$60 million in assets. We offer returns ranging from 4% to 10%, investing mainly in Mutual Mortgages, Preferred Equity and Promissory Notes.