The release of U.S. CPI data for the month of May provided another upside surprise in inflation. Monthly CPI inflation was 0.6% in May, down from 0.8% in April, but enough to push annual CPI inflation to 5.0% from 4.2% in April. This is the highest annual inflation rate recorded since 2008.

Core inflation, defined as "all items less food and energy," rose 0.7% in May, down from 0.9% in April, but lifted annual core inflation to 3.8% from 3.0% in April.

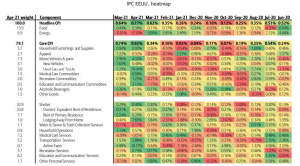

How much of this increase still fits into the transitory logic? Together, new and used cars contributed 37 bps to the underlying CPI, accounting for half of this month's increase (see table). The automotive sector is still affected by the global chip shortage and it is difficult to predict how long this effect will last, as the situation will take time to resolve, even beyond 2021.

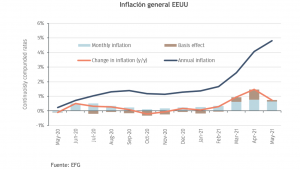

With monthly inflation at high levels in March, April and May, it is clear that a new picture of inflation is emerging. Annual inflation rises if the observations leaving are smaller than the observations entering the calculations. In fact, as shown in the chart, this "base effect" played an important role in the rise in inflation in March and April as expected, but was less influential in May.

It is now increasingly clear that the new monthly inflation rates are also high. To stabilize inflation at 2%, monthly inflation rates should average 0.17%. However, in February monthly inflation was 0.4%, in March 0.6%, in April 0.8% and now in May 0.6%. While it is too early to say how monthly inflation rates will evolve in the coming months, further declines are necessary for the rise in inflation to be temporary.