After a stellar 2020 year, renewable energy investments have become more volatile and are trading well below the general market.

There are several factors behind this trend, including geopolitical tensions, supply chain-induced shortage concerns, uncertainty regarding Biden's tax plan, and some pressure on valuations due to rising interest rates.

- Of all these factors, supply chain disruption and geopolitics remain a central theme for short-term investors. The impact of supply chain disruption varies greatly by company and market. Now, studies suggest that most existing utility-scale projects are still underway, while some new project decisions are being introduced in FY2022. In the residential market, price increases are being passed on to customers and demand remains strong.

- Demand remains strong within the U.S. residential market, although some new utility-scale projects may be delayed due to cost increases and logistical challenges. Existing utility-scale projects appear to be moving ahead on track.

- Supply chain challenges appear to be stable, not deteriorating.Shipping and logistics remain the common headwind across the industry. For now, panels are allowed into the U.S. with the exception of one Chinese supplier and large installers appear to be able to meet the demand for new shipments, plus the visibility provided by strategically elevated inventory.

An industry with great potential

The U.S. Department of Energy recently published aSolar Futures Study (Solar Futures Study | Department of Energy), assessing the potential role of solar energy in decarbonization. The study includes a base case scenario that generally aligns with BNEF (Bloomberg New Energy Finance) forecasts and estimates that power sector emissions will decline 45% from 2005 levels by 2035. However, two other "decarbonization" scenarios, which assume that power sector emissions decline 95% from 2005 levels by 2035, point to the need for solar deployments to reach up to 40% of electricity supply by 2035, compared to ~ 4% today. The decarbonization scenarios would need solar to grow by an average of 30 GW annually through 2025 and increase to 60 GW annually between 2025 and 2030 (deployments in 2020 were ~ 19 GW). We believe these studies could prove critical in policy decision-making for the potential U.S. budget reconciliation bill, as well as for U.S. commitments to the upcoming COP26 UN conference in November.

Possible positive catalysts on the horizon

- In addition to company-specific catalysts (with 3Q21 corporate results of the most representative companies in the sector far exceeding estimates), investors are very focused on potential positive catalysts for the industry in general, mainly from government regulation / incentives, which could make the strong secular tailwinds even better. We believe governments could present more detailed plans, including short- and medium-term targets, for the long-term decarbonization goals already provided for the UN COP26 meeting in early November.

- In a recent J.P Morgan survey, market participants appear optimistic about the potential for incremental government incentives, whether as part of the budget reconciliation bill or otherwise.The extension and expansion of ITCs to include independent storage, as well as the direct payment option, are seen as important drivers of industry growth. There is also some optimism that incentives for domestic manufacturing could be forthcoming, which would be less disruptive to the U.S. government's climate change goals while diversifying the global supply chain. That said, uncertainty remains about the possible expansion of import restrictions, as well as the possible expansion of antidumping/countervailing duties on panels manufactured in Southeast Asia.

Biden's Fiscal Plan

While the market has become more skeptical that the U.S. budget reconciliation bill will pass in its current form, the clean energy portion would not be at risk.

Otherwisewe note that many relevant companies in the sector are trading at a discount to the average multiple immediately ahead of the 2020 US elections, so even the passage of a scaled-down version of the bill would likely be viewed favorably.

Biden's new tax plan framework has $555 billion for clean energy, focused on incentives.

- The spending would represent the largest climate investment in U.S. history.

- Spending targets emission-reducing technologies in buildings, transportation, industry, electricity and agriculture.

- The initiatives will begin to reduce pollution now, with more than one gigaton of greenhouse gas emissions reduced by 2030, according to the plan's framework. This will put the U.S. on a path to reduce emissions by 50% to 52% below 2005 levels by 2030.

- The plan includes a 10-year expansion of tax credits for residential and utility-scale clean energy, transmission, storage, electric vehicles and clean energy manufacturing. More than $100 billion is set aside for resilience investments as extreme weather events, including wildfires fueled by climate change, hit the US.

- The plan also seeks to boost domestic manufacturing around clean energy. Biden has said this will create hundreds of thousands of new jobs.

Some market commentaries and investment opportunities

- Some market trends may seem contradictory to some. Over the last 12 months gas prices have increased by 450%, coal prices have almost quadrupled and, as a result, future energy prices have more than doubled. This has led to a 35% to 50% increase in end-user energy bills across Europe (which is where the effect of rising gas prices is most felt).

- Many of these trends are associated with supply issues, lack of investment visibility in traditional energy sectors and stronger demand as pandemic-related constraints begin to ease. But, we believe this should also accelerate decision making to promote low-cost clean energy.

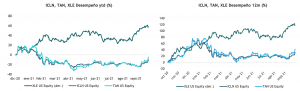

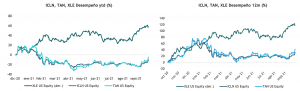

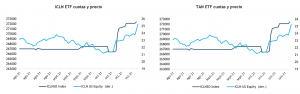

- So far this year, due to the rise in oil prices, the U.S. energy sector has returned 58%, while renewable benchmarks such as the ICLN (SHARES GLOBAL CLEAN ENERGY ETF) or the solar benchmark TAN (INVESCO SOLAR ETF) have fallen by 10% and 5% respectively. In the 12-month term the differences remain, while the XLE energy sector has returned 119%, the renewable benchmarks ICLN and TAN have returned only 32% and 42% respectively, which by the way is a very good performance, but it is striking how far they lag behind traditional energies.

- That said, things have started to turn around in October, also on the back of positive corporate results in the last week. So far in October, the clean energy ETF (ICLN) has returned 15.5% in 30 days, while the benchmark for solar companies (TAN) has returned +22.5% over the same period. That compares positively to +9.38% for the traditional energy sector (XLE) and the broader market +5.7% (S&P 500).

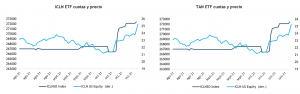

- Investors otherwise seem to be moving more decisively back into renewable sectors, as evidenced by strong share creations in the sector's ETFs in recent weeks.

- Finally, we believe there is more upside ahead and we see a lot of potential in clean energy, which is well worth making room for in an international equity portfolio with a long-term outlook, or as a tactical opportunity for transactional profiles.

Investment downturn

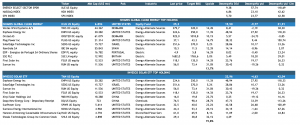

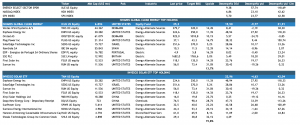

- ISHARES GLOBAL CLEAN ENERGY ETF (ICLN)

Humberto Mora

Strategy and Investments