So far our scenario considers an IPSA target of 4,900 points. We base our projections on a relatively conservative scenario in terms of valuations, understanding that the local scenario would continue to be challenging with a heavy electoral agenda that includes the constituent process and a presidential election, but given the magnitude and timing of monetary and fiscal stimulus, falling interest rates, discounted valuations, the weakening of the dollar globally and the recovery of commodity prices, would offset domestic political and electoral risks.

Well, we are already reaching fair value levels for the IPSA, well in advance, and the question that follows is, is there any value left in local stocks?

Looking ahead to the remainder of 2021 and incorporating the new information available, there are reasons to be a little more optimistic (or if you prefer, "less pessimistic")

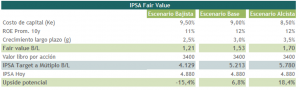

So far we have worked with a fairly conservative valuation scenario, with a stock/book fair value multiple close to 1.4x (-1ds of their long-term averages of 1.7x), which considers an average profitability scenario (ROE of 11%), a cost of capital (ke) of 8.5% and long-term growth (g) of 3.0%.

Now, let's recognize the higher implicit risk of investing in local stocks with a higher discount rate (+50 bps) at 9.0%, but with an additional return scenario of +100 bps (ROE of 12%), for the same long-term growth (g=3.0%), that translates into an IPSA around 5,200 points that has an implicit B/L multiple of 1.5x (see table 1).

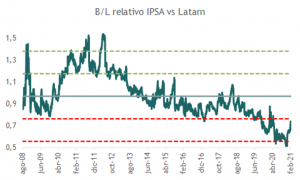

We obtain the same results under a relative approach with the region. Despite the IPSA's recovery in recent months, it still looks attractive compared to Latin America and even more so with respect to emerging markets.

We believe that such a large discount with respect to the region would no longer be justified.We believe that we will grow more, we have demonstrated a better management of the pandemic, not to mention our successful vaccination process. Today the IPSA is trading at a 25% discount to Latam in terms of B/L (see chart 1).

IPSA base scenario and risk scenarios

IPSA multiple Bolsa Book relative to Latam