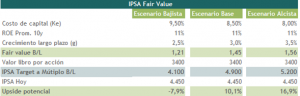

In local equities, our base scenario considers a 2021 IPSA target of 4,900 points. The local scenario would continue to be challenging, although we believe that given the magnitude and timing of monetary and fiscal stimulus, the fall in interest rates, discounted valuations both in absolute and EM terms (50% discount in B/L terms), the weakening of the dollar globally and the recovery of commodity prices, offers some compensation.

Earnings would show a significant recovery in 2021 and, in our view, Chilean equities already incorporate the higher political risk post October 2019 "social outburst".

Meanwhile, we see that flows are returning to local equities, with a greater participation of retail investments from mutual funds, which add to the foreign investment flows observed in previous months.

We continue to favor papers that we find undervalued (value), of quality (solid financial position), and that benefit from higher commodity prices and from fiscal transfers and available flows from pension fund withdrawals. Sector-wise we are favoring commodities, banks, retail and real estate.

We see 3 major risks to our baseline scenario: a new outbreak of Covid-19 and obstacles in the vaccination process, institutional political deterioration and violence returning to the streets in the midst of the constituent process.