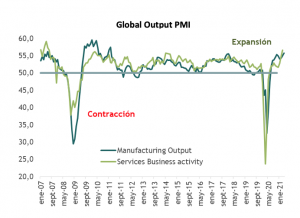

The rebound in economic growth since the turn-of-the-year slowdown continued to gain momentum at the start of the current quarter. Immediately following a 1.6-point jump in March, the JP Morgan Global PMI strengthened another 1.5 points in April and now stands at nearly a 14-year high. The recovery is all the more remarkable given that the survey barely registered a pullback during the second wave of the pandemic.

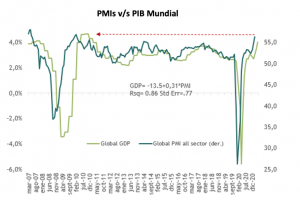

At 56.3, the composite reading in the global all-industry PMI is consistent with nearly 4% ar growth in global GDP. While this is below estimates for 6% growth in global GDP this quarter, it is typical for PMIs not to capture extremes. Given that global GDP in the coming quarter is forecast to expand at one of its fastest rates in decades, it should come as no surprise that the PMIs are underperforming. Rather, the message from the PMIs is twofold: 1) the rapid increase is consistent with a strong acceleration in activity, and 2) the nearly 14-year high is consistent with booming growth.

Equally encouraging in the April report are signs that the global service sector is coming back to life. The global pandemic recession of 2020 was unique both (if not more so) in its impact on service sector activity and in the depth of the recession. As a result, the global services output PMI spent 13 months below the manufacturing output PMI. This underperformance ended in April, with the services PMI rising almost 2 points to 56.6, almost a full point above the manufacturing production PMI, which also advanced 0.9 points.

While the April survey shows a significant breadth of strength across all sectors and components, it is tempered in part by larger gains in the U.S. and U.K. compared to more modest, but still solid, gains elsewhere. Both the U.S. and the U.K. have made considerable gains in vaccinations in recent months. At the same time, increased fiscal stimulus in the U.S. is adding further fuel to its boom through the second wave. Elsewhere, the recovery has slowed more markedly. These regional divergences should close in the coming months with increased normalization in Europe and indirect growth in the rest of the world.

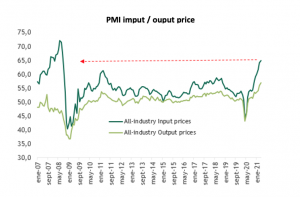

With economic activity accelerating sharply, bottleneck pressures from disruptions in some supply chains are evident in the PMI prices. In recent months, a significant increase in the input price PMI has been observed, and these pressures could eventually spill over to overall consumer price inflation.