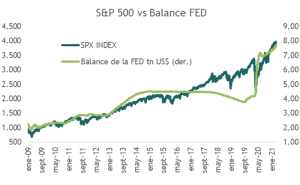

The trajectories of market performance and the Fed's balance sheet are strongly correlated. Total assets on the Fed's balance sheet have expanded from $2.24 trillion at the end of 2008 to the current level of about $7.7 trillion, for growth of 244%, while the S&P 500 rose from 903.25 to approximately 3,900 points, gaining cumulative growth of about 330% over the same period. (see chart 1).

Granted, they are not exactly equal numbers, but look at what has happened in pandemic, when earnings have fallen and the entire equity return is explained by expanding multiples. The Fed's balance sheet has increased from $4.67 trillion on March 18, 2020 (one week before the market bottom) to $7.7 trillion, up 65%, while the S&P 500 is up 64% over the same period. That sure looks like it, doesn't it?

Since mid-February this year equity markets have struggled to sustain the uptrend, amid a rapid rise in sovereign yields that has tested high market valuations, but also amid reduced liquidity provided by major central banks (see chart 2).

It is not that asset purchases have stopped (G-10 central banks would buy close to US$300 billion per month by 2021), but the pace of purchases has moderated. How long will this last? Hopefully not long as central banks have become increasingly sensitive to liquidity adjustments and how they impact prices.

For example, 3 buttons:

The European Central Bank (ECB) signaled two weeks ago that it will buy more debt so that rising interest rates do not stifle the recovery, not that it has increased the size of the purchase program (at least not yet), but that the pace of purchases will increase. not that it has increased the size of the purchase program (at least not for now), but that the pace of purchases will increase.

Chinese stocks have struggled more this year, because of regulatory issues, but also because of the growing expectation of tighter monetary policy. China has not been as conservative in its cash offerings to banks in nearly a year, and the People's Bank of China has avoided net injections of short-term liquidity into the financial system since late last month, adding to concerns that access to funds is becoming increasingly difficult. How long will it last? After a 15% drop in Chinese stocks since mid-February, probably not much longer.

Japanese stocks saw a broad-based sell-off in recent days after the Bank of Japan (BOJ) signaled last week that it is eliminating its annual stock buyback target. And surprise!!! The BOJ had to come back into the market more aggressively to buy a record amount of shares (70 bn) and stop the decline (which it has so far succeeded in doing).