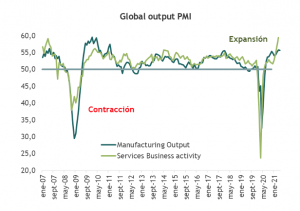

The global economy continues to boom, according to May business surveys. JP Morgan's all-industry manufacturing PMI jumped to a new high last month, with continued gains in manufacturing coupled with an impressive increase in service sector activity.

The strength of the surveys is broad-based, but most recently they have been led by the U.S. and Europe, while lagging in much of the emerging markets where vaccination rates have been slow to increase.while lagging in much of the emerging markets where vaccination rates have been slow to increase.

The strength of the manufacturing PMIs is broadly based across all sectors. More than 80% of countries have an average manufacturing production PMI above those of 2010-19, while the breadth of service sector strength now stands at above 70%. Despite the breadth, divergences continued to open up. The upswing in the May surveys is tempered in part by the huge gain in the US and underperformance in much of emerging markets. Still, the substantial improvements in Europe are a positive sign that the pandemic drags of the second wave are fading fast.

At the regional level, the strength in the May services PMI survey was also mixed.. The services PMI registered a decline in Asia last month versus increases elsewhere. The most impressive gains were seen in the U.S. and the euro area, where the PMI jumped about five points. The U.S. PMI ended at 70.1 and the euro area index at 55.2. Japan and India were at the bottom of the range with declines in May bringing the level to 46 in both economies. China's PMI fell 1.2 points to 55.1. Despite national and regional divergences in the May changes, the breadth of solid readings remains impressive, with 70-80% of all countries posting output readings above their 2010-19 averages.

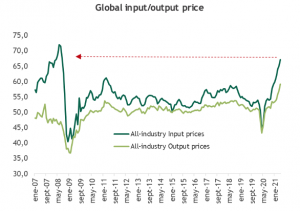

With signs of strong new order flows in all sectors and low inventories in the manufacturing sector, there is considerable support for the view that this is just the beginning of the post-Second Wave boom. Bottleneck pressures continue to build and price indicators rose further in May to unprecedented levels.