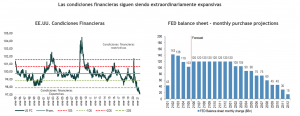

The minutes of the July FOMC meeting reported that "most" participants judged that it might be appropriate to begin reducing the pace of asset purchases "this year" if the economy evolves in line with their expectations. "Several" participants noted that an earlier start to tapering could be accompanied by a slower pace of tapering, and "most" participants saw benefits from proportionately reducing the pace of Treasury and MBS purchases.

The minutes also provided new insight into the FOMC's views on the interaction between tapering asset purchases and raising the policy rate. "Many" participants saw benefits to ending asset purchases before reaching the conditions specified in the policy rate guidance. "Many" participants noted that, in beginning to taper asset purchases, the Committee should clearly reaffirm the absence of any mechanical link between the timing of tapering and liftoff, while "a few" suggested that a premature start to tapering could call into question the Committee's Commitment to its new monetary policy framework.

Taken literally, the comment in the minutes that most participants "judged that it might be appropriate to begin reducing the pace of asset purchases this year" also implies a formal announcement for November rather than December because the reductions are not implemented until the month after the announcement, although this may be too literal a reading .

If the FOMC intends to taper in November, it is expected that it would want to include a formal warning in the September FOMC statement, and Chairman Powell could also include a hint in his Jackson Hole speech. However, we still see a significant chance that the formal announcement will be made after November due to considerable uncertainty about the impact of the Delta variant on the economy and the possibility of lackluster data delaying the FOMC's early warning last September.

Indeed, with unemployment levels falling and inflation rising, the Fed should ease monetary policy. However, reducing liquidity would cause asset prices to fall, hamper consumer confidence and further contract economic growth.

As background, U.S. consumer confidence fell sharply in early August to its lowest level in a decade in a worrisome sign for the economy as Americans offered hesitant outlooks on everything from personal finances to inflation and employment.