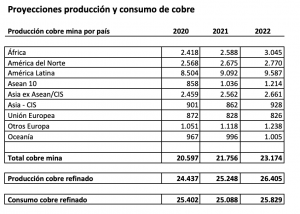

Copper, like other commodities, has been in the economic discussion in recent days. Fears of inflation and the Chinese government's announcement to monitor markets more closely to protect consumers from rising commodity prices have cooled the mood in the face of an expected price super cycle. Cochilco, for its part, revised upwards its average price projections for copper for 2021, placing it at US$4.3 per pound. Concerns about the future of copper will continue in the coming weeks, fueled by the increased political risk in Chile and Peru, which account for almost half of copper mine production. The results of the elections in Chile this weekend and the second round of the presidential election in Peru on June 6, where the leftist candidate Pedro Castillo shows a slight lead in the polls, are causing uncertainty in the market. In both cases the outlook is marked by the specter of an aggressive increase in mining taxes (in Chile there is already a bill under discussion in the market). Lundin Mining, for example, announced that it will put a US$500 million investment plan for its Chilean operations on hold. In the meantime, let us see in this chart how the International Copper Study Group projects copper production and consumption.