Inflation has continued to surprise on the upside recently: PCE exceeded expectations in the US and inflation has picked up in Europe. While breakevens have priced in further reflation, nominal and real rates have reacted less recently, in part due to continued dovish signals from the Fed.

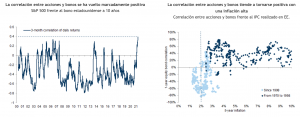

As markets continue to scrutinize the risks of an excessive rise in inflation, the correlation between stocks and bonds has turned sharply positive, reaching a two-decade high. A positive turn in the correlation is also consistent with higher levels of realized inflation (see charts).

The correlation between stocks and bonds has been structurally negative over the past two decades, in line with historically low inflation, but we find that inflation above 2% has generally resulted in a more positive correlation.

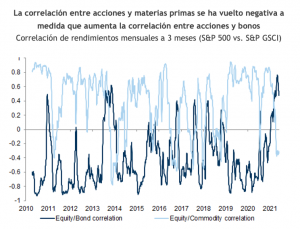

For investors concerned about higher inflation or the surprises of tighter monetary policy and the impact on the correlation between stocks and bonds, we believe that commodities continue to offer the best inflation hedge. The correlation between equities and commodities has been positive in the Covid-19 recovery, but has recently turned more negative, offering more diversification possibilities outside of equities and bonds. We also continue to prefer shorter duration stocks such as value stocks and markets outside the U.S., which have a more negative correlation with bonds.