The financial conditions index for the U.S. constructed by GS is a weighted average of risk-free interest rates, the exchange rate, equity valuations and credit spreads, with weights corresponding to the direct impact of each variable on GDP.

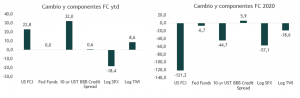

While U.S. financial conditions have tightened about 25 bps so far in 2021, they remain at historically accommodative levels. Lower rates (despite the recent selloff), a weaker dollar, and especially higher equity prices have driven a net easing of nearly 100 bps in the US GS. FCI gauge relative to its pre-pandemic level.

The current level of U.S. FCI remains approximately 2 standard deviations more accommodative than its historical average (see attached chart).

This substantial easing in the US FCI supports the prospect of upside growth in the US, which together with the vaccine-induced reopening, fiscal stimulus and accumulated savings, is a good backdrop for risk assets.