Today there are 2 proposals from the opposition for:

Although both bills could be rejected by the Constitutional Court, the fact is that they have been gaining strength, due to the support of multilateral organizations for the increase in tax collection to face the effects of the pandemic on public spending and because the third withdrawal of 10% of the PFAs has already been approved by the Chamber of Deputies by a large majority, now passing to the Senate, which will discuss and vote on it next week.

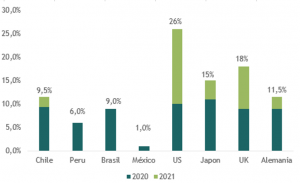

Chile has deployed a powerful fiscal response, placing itself at the forefront of both the economies of the region and emerging countries at the global level (see chart).

Whether or not the third withdrawal of pension funds is approved or other alternatives that are currently on the table, such as the withdrawal of severance insurance funds, and with quarantines extending for a longer period of time, it is likely that the government will have to make an even greater effort in fiscal terms, thus strengthening an already abundant liquidity environment .

What is the practical effect of this increased liquidity in local assets, at least for the short term?

It is generally good for consumption (positive for retail companies), may continue to improve asset quality as people pay more of their debt with excess liquidity (positive for banks) and has the potential to generate higher inflation (positive for UF accruals).

In the long term, if the additional liquidity comes from another PFA withdrawal, it could be read as an indirect increase in government debt, which could continue to put pressure on long market rates.

Fiscal stimulus 2020 - 2021 (% of GDP)

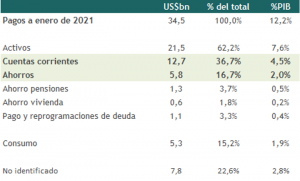

Liquidity of US$12.7 billion in consumer current accounts (4.5% of GDP)