In line with the explosion of mergers and acquisitions, structured debt issuance jumped sharply during the first half of 2021. According to an analysis by S&P Ratings, new structured debt issuance in the first six months of the year was up 60% over the same period last year, ahead of projections and reaching US$685 billion. This figure also represents a 30% increase over that of the first half of 2019. With this result, S&P Ratings projects that the year will end with about US$1.4 trillion (billion) in new structured debt issuance, the largest volume in real terms since the Great Recession.

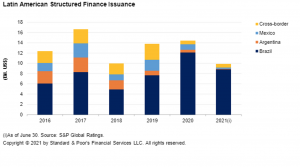

Latin America has not been immune to the trend and also exceeded S&P Ratings' expectations, with a volume of US$10 billion in the first half of the year. Brazil concentrates the bulk of the activity and the agency expects it to continue to show dynamism in the second half of the year given the favorable interest rate conditions. S&P Ratings raised its projection for structured debt issuance in Latin America by 20% for the whole of 2021 to US$17.5 billion.