A lot of focus on interest rates, but what happens to companies' earnings in an environment of improved growth expectations? Significant easing of monetary and fiscal policy during the current recession helps explain why stocks have recovered so quickly from the March 2020 low. We believe we are still in the early stages of a new bull market. Although there are correction risks, equity markets have proven that any correction is a buying opportunity.

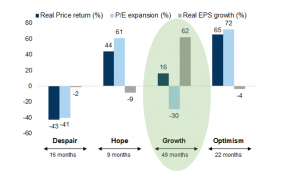

The initial powerful rally in equity markets between March and September of last year, driven by valuation, is very typical of the initial 'hope' phase of a bull market, which usually begins during a recession when earnings are still falling.

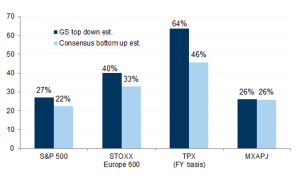

This phase is usually followed by what we call the 'growth' phase, which is the expectation for this year, as global equities generate earnings growth of around 30%.

Often, the transition between the two phases is marked by increased volatility, which is what we are seeing today as interest rates recover.

While we recognize the risk that higher interest rates have on somewhat stretched valuations, we question the focus on that factor alone and not on the expected strong rebound in corporate earnings for this year (see chart 1) and next year. As Chart 2 shows, the growth phase continues to generate positive returns for equities, explained by a strong earnings recovery, partially offset by a compression of multiples.

Top-down vs. bottom-up consensus EPS growth estimates 2021

We are currently entering the "Growth" phase of the new cycle.