Building portfolios capable of generating attractive returns for investors with acceptable levels of risk is probably at its most challenging moment, given a context of low fixed income rates and high equity valuations, in addition to a rising inflation outlook. This is why the traditional Bond/Share mix that has worked so well over the last 40 years needs to be reconsidered and new allocation models deployed.

Among the most promising opportunities available are the "Core" Alternative Asset classes, which offer low volatility and attractive diversification characteristics. They are Core Alternative Asset classes if a large percentage of the total return comes from cash income and their cash flows can be forecast over long periods of time with a low margin of error. Examples of this could be Senior Secured Loans or Real Estate Assets.

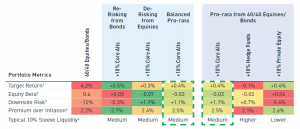

A mere 10% of the portfolio dedicated to "Core" Alternative Assets can considerably improve portfolio returns, either by switching to bonds, stocks or a balanced decision between both options. For example, you can increase the expected annual return by +0.5% by redirecting allocation from bonds to Core Alternatives, while you can improve downside risk by 1.9% by swapping stocks for these asset classes.

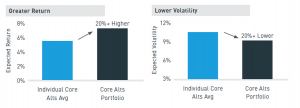

Cross-correlations within the Core Alternative Asset universe result from fundamentally different return drivers for each asset class. All components of a portfolio should be assembled in such a way that there is a low correlation between each component, thus delivering higher returns with lower volatility than if a portfolio with only one Alternative Asset class were chosen, as can be seen in the following graphs.

Shifting 10% of the portfolio to Alternative Assets, while providing less liquidity, is within the liquidity budget that most investors accept, especially in an environment where the public market is expected to deliver unacceptably low rates.

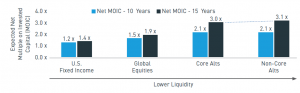

Further elaborating on the above, when reviewing the spectrum of less liquid assets, the "Core" Alternatives have a more or less hybrid liquidity characteristic, with relatively short closes and higher cash flows than those available in some areas of the private markets. Since many investors will not require immediate use of the income stream, reinvestment of income within the "Core" Alternatives can generate net return multiples equivalent to those with less liquid strategies such as Private Equity.

Investors' portfolios continue to be comprised of stocks and bonds, despite well-founded concerns that it will not be possible to achieve levels of returns and risk consistent with historical experience. In this context, investors need solutions that can enhance returns without adding risk. Core Alternative Assets are a solution just around the corner that can generate stable returns above public markets, while providing attractive downside risk protection along with resilience to inflation and rising rates.

Source: Preqin and JP Morgan Asset Management.