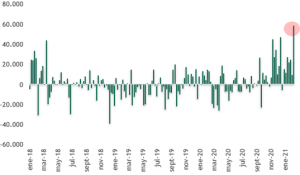

Net flows into global equity funds reached a record + US$ 58 billion in the week ending February 10. US$ 58 billion in the week ending February 10. (see attached chart)

Among the positioning indicators, fund flows have become decisively more positive since November. Fund flows over the last 3 months have been the largest since 2000 (when data became available), raising concerns that inflows into equities may have gone too far.

While strong equity fund inflows appear stretched and are likely to moderate from here, the strong recovery follows very large outflows since 2018. Outflows have totaled U$700 billion since 2018, compared to inflows of US$250 billion since November (i.e., a recovery of approximately 35%).

With growth improving steadily this year and uncertainty fading, equity fund flows can remain positive in 2021. In particular, we believe there is scope for further rotation, as fund flows into safer assets have remained solidrisky vs. safe asset fund flows on a 12-month basis remain very negative. Bond fund flows have remained strong and confidence in bonds looks particularly vulnerable to key risks, such as an unexpected rise in inflation. In addition, we believe there could be further outflows from money market funds as the yield curve continues to steepen.

Global Equity Fund Flows