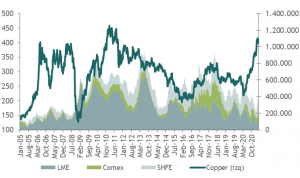

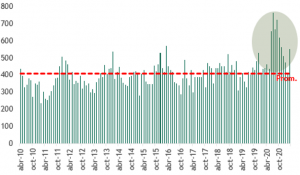

China's demand for copper remains strong. China's foreign trade data this week showed that copper imports were up 25% in March from a year earlier, totaling 552,317 tonnes (see chart).

Meanwhile, copper imports in the first quarter totaled 1.44 million tons, a year-on-year increase of 11.9% and the highest amount for the first quarter since at least 2008.

This increased demand comes against a backdrop where manufacturing activity expanded at a faster-than-expected pace in March after a pause during the Lunar New Year holidays, while activity in the copper-intensive construction sector has also grown at a good pace.

The outlook for raw materials, particularly copper, remains favorable.

A recent GS report argues that, fundamentally, the copper market is currently unprepared for an environment of increased demand from the green transition. As the most cost-effective conductive material, copper is at the heart of capturing, storing and transporting these new energy sources.

The market is already tight because of pandemic stimulus (particularly in China) that has supported a resurgence in demand when there is stagnant supply conditions, keeping inventories at historically low levels (see graph). In addition, a decade of low yields and ESG concerns have reduced investment in future supply growth, bringing the market closer to peak supply.

Despite an 80% recovery in copper prices over the past 12 months, there have been no material approvals of greenfield projects. The coronavirus has only exacerbated this dynamic, creating enough uncertainty to put companies' investment decisions on hold.. This combination of rising demand and tight supply has reinforced the current deficit conditions.

Estimates point to a supply gap of 8.2Mt by 2030, double the size of the gap that triggered the copper bull market in the early 2000s.

China copper imports (thousands tn.)

Copper and inventories