We remain pro-risk, that is OW on equities and commodities and a UW on bonds. The pandemic reopening should continue as vaccination spreads to children and new highly effective antiviral treatments are implemented, while the number of COVID cases globally has remained stable in recent weeks and well below summer peaks.

We continue to expect this reopening trend to lead to a strong cyclical recovery as pent-up consumer demand unwinds and businesses increase capital spending and rebuild depressed inventories.

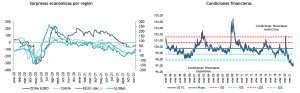

Although growth is slowing and inflation is rising, we do not foresee a "stagflation" scenario, as demand remains strong and financial conditions lax.

The Fed's stance against premature tightening supports a pro-risk stance. The market implications of a central bank pulling back on liftoff are bullish for risk assets such as equities and credit, and should favor steepening the curve on rates.

Against this backdrop, risk assets would continue to do well and bond yields appear to be finding a floor, which generally bodes well for cyclical value leadership.

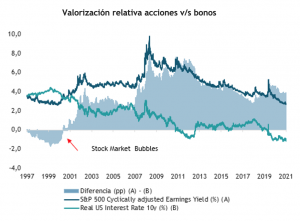

We see a lot of emphasis on high equity valuations, but little talk about the unattractiveness of prime rates. Bonds appear to be more disconnected from fundamentals and will therefore be more vulnerable to inflation and policy risk.

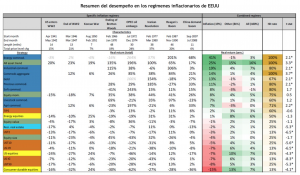

In this regard we believe the correct approach is to continue to overweight equities over fixed income, where relative valuations continue to offer a large premium to their history and equities are the only asset class that produces positive real returns and tend to perform well in a higher inflation regime, while for fixed income we recommend a conservative approach in terms of duration.

Particularly for equities, the impact of the Delta variant has been better than expected in terms of both severity and constraints, and supply constraint metrics are showing some very early signs of renewal. Meanwhile, 3Q corporate earnings have been solid across all regions, with cyclical sectors performing well. Overall, the Cyclical / Value rotation is durable, given record discounts in the Value v/s Growth and yield-sensitive sectors.

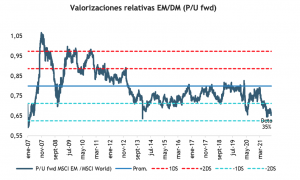

Beyond the US, we see opportunities in Chinese equities on the assumption that the slowdown is nearing its end and the possibility of improving relations with the US on trade and climate cooperation.

If this is correct, emerging market equities could start to do better, given favorable positioning and relative valuations, and their indexation to commodity prices.

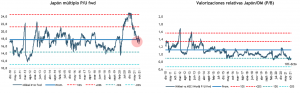

We are bullish on Japanese equities given the valuation gap and foreign investors should become net buyers as the benefits of policy change pay off.

Finally... looking to hedge against higher inflation? Add commodity positions to your portfolios. Gold shows a good entry point in tactical terms.

Humberto Mora

Strategy and Investments FYNSA