The bullish commodity thesis is neither about Chinese speculators nor Chinese demand growth. It is increasingly about scarcity and recovery driven by developed markets. Prices have pulled back following Chinese warnings about commodity speculation, yet the fundamental path in key commodities such as oil, copper and iron ore remains geared toward further supply and demand tightness, with little evidence of a supply response sufficient to derail this bull market.

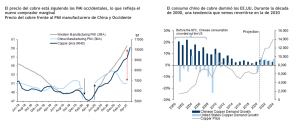

The speed of the recovery in DM demand means that China is no longer the marginal buyer dictating prices, as it is displaced by the Western consumer. The market is beginning to reflect this, as, for example, copper prices are increasingly driven by Western rather than Chinese manufacturing data (see charts).

The immediate reason for the greater pricing power of the United States is the large fiscal stimulus that is absent in China; however, there are also structural factors that make this a paradigm shift. China no longer benefits so much from its comparative advantage in low-cost labor, global trade and its previous disregard for the environmental impact of GHG emissions.

The vision of a commodity supercycle is a global vision, not China-centric. It is based on a globally synchronized policy aimed at environmental policies (the "war on Climate Change") and greater versatility in supply chain initiatives (the trade war).

Finally, we continue to see growing value in commodities from a strategic asset allocation perspectiveIn periods of high and rising inflation, commodities can be a good diversifier for balanced portfolios; when stocks and bonds decline together due to inflation risk, commodities have often decoupled and offered attractive carry.