During the last few weeks Chile has experienced a series of political and economic events that have increased uncertainty and changed the outlook for investors.

Our globalized market allows us to access business opportunities that may arise in other countries, which can be an important source for those seeking to diversify their investments and protect their wealth.

In this context, the U.S. real estate market has become a very relevant sector to bet on, where a robust and growing economy, rising demographic rates, low tax burdens in some states and a real estate market that has proven to be more resilient than other markets in times of crisis, make it an attractive sector to invest in.

Why Multifamily?

Multifamily buildings are real estate projects of residential buildings, which are acquired and managed by a single owner, generally institutional, and where the apartments are intended solely and exclusively for rent.

Demographic growth, rising housing prices, a higher proportion of the millennial population, which is now between 24 and 40 years old, and the resilience it has shown in times of crisis, position the multifamily business as one of the best opportunities for investment.

Buying a home in the U.S. has become increasingly unaffordable due to several factors. On the one hand, housing prices have increased by 60% in the last decade[1], yet the median household income has evolved at lower rates. Another effect that intensifies this reality is the fact that practically three out of every four apartments being developed require incomes over USD 75 thousand per year to be purchased, yet less than 20% of people in the US reach that level of annual income. This reality implies that the majority of the population is unable to purchase their own home, and are therefore opting to rent.

On the other hand, the millennial population is a sector with a high potential demand for residential apartment leases. This group represents about 25% of the total U.S. population, which translates into 75 million people, who have a preference for leasing, tend to stay less time in one place and prioritize access to services and mobility.

According to the study prepared by CBRE Econometric Advisors, total U.S. demand for multifamily housing should increase by 2 million units over the next ten years.

Another notable feature of the U.S. multifamily market is that it has shown itself to be consistently more resilient during downturns than other real estate asset classes, where it can be observed that after the economic crises of 2001, the U.S. multifamily market has been more resilient than other real estate asset classes.

and 2008 multifamily projects had the smallest drop in revenues and were the first sector to recover from the 2008 recession.

[1] JCHS tabulations of BLS, Consumer Price Indexes.

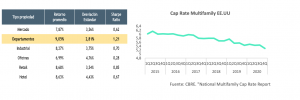

During the last decade, multifamily assets have experienced the highest average yields in the real estate industry, with lower income volatility, which translates into a better risk-return ratio. This is explained by the intrinsic characteristics of this type of assets, where risk is diversified through an atomized portfolio of tenants, stable flows and lower Cap Rates, which have been falling, standing at an average of 5.28% at the national level3.

The multifamily business has taken its rightful place in the U.S. real estate market and has favorable characteristics that suggest it will continue to develop more strongly in the coming years, providing a clear and concrete opportunity for investors who want to diversify and seek higher risk-adjusted returns.