U.S. CPI data released this week showed strong increases in headline and core inflation. With headline inflation rising to 2.6% and core inflation reaching 1.6%, many are wondering if U.S. inflation is getting out of control.

However, these increases are largely expected and reflect the "base effect" - the fact that headline and core CPI levels fell due to Covid-19 from February to May 2020 caused inflation to fall sharply at that time. But as these price declines are removed from inflation calculations twelve months later, inflation will inevitably rise sharply. However, it is important to note that this does not mean that the current inflation rate has risen permanently: inflation will fade in the second half of this year as the base effect wears off.

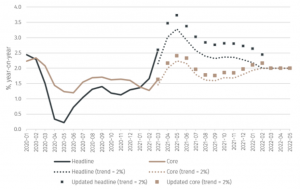

To show the importance of the base effect, the calculations below assume that headline and core inflation grow at a constant annual trend rate of 2% starting in February 2021. Under this assumption, the headline rate for March was forecast to be 2.2% and the core inflation rate was forecast to be 1.5%. In addition, inflation is projected to continue to rise, with headline inflation peaking at 3.4% in May and core inflation at 2.4% in the same month (see dotted lines in the chart).

The fact that inflation in March was higher than expected implies that the updated inflation trajectories are slightly above the previously forecast trajectories, but their shapes remain similar. Headline inflation is now expected to peak at 3.7% and core inflation at 2.4% in May, before starting to decline towards 2% as the baseline effect wears off.

Source: EFG