Beyond the obvious slowdown in the global economy in recent months as a result of the flare-ups associated with Covid-19, we believe this should be adequately offset by greater policy support, especially in China, which would move from financial repression to something more friendly, either by easing monetary policy or some more targeted fiscal stimulus, or a Federal Reserve that has to delay any announcement of reduced asset purchases to December, which remains our baseline scenario.

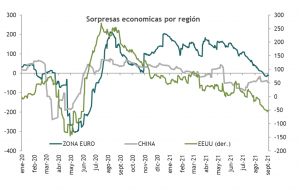

However, we have always argued that this post-Covid recovery would not be without challenges, that it would be uneven across regions and that it would eventually take the form of a "staggered recovery", as different regions were affected by COVID-19 in different periods of time.as different regions were affected by COVID-19 in different time periods. China was first in, first out, and the US subsequently recovered (peak quarterly GDP growth was highest in 2Q21), followed by Europe (peak quarterly GDP growth 3Q21) and finally emerging markets ex-China, all in tandem with the easing of COVID-19 mobility restrictions.

These different recovery times help explain the performance of assets in different regions very well, with the U.S. exceptionally strong, which has been the driving force for global equities for much of the year, and now we see Europe catching up. EM is next in line? As vaccinations increase and the reopening occurs, emerging markets are expected to reestablish the GDP growth premium versus US GDP for 4Q21 and thus resume outperforming equities.

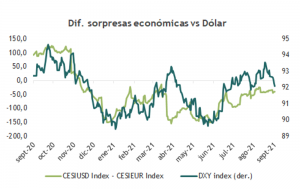

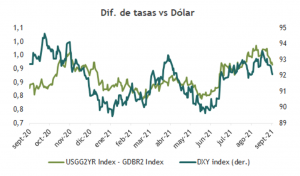

But let's come to what we are talking about today. These same divergences in economic terms allow us to explain the behavior of the currency market quite well. A stronger US, and the expectation of an early normalization by the Fed, has led to a stronger dollar, leading the market to drastically reduce its original expectations of a lower dollar in 2021.

Well, we have not yet given up our thesis of further dollar weakness, and recent events give us enough confidence to persist in our call for a weaker dollar, but we have not yet given up our thesis of further dollar weakness, and recent events give us enough confidence to persist in our call for a weaker dollar.. While economic data has been disappointing in most regions, after China, the US is where it has been most evident (just look at this week's disappointing employment data and the substantial drop in consumer confidence, to name a few).

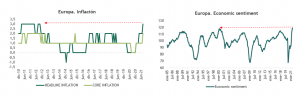

But, if we look at Europe, the loss of momentum has been more moderate, and with a not inconsiderable guest of stone, higher inflationThis has even led to calls within the ECB for an early withdrawal of stimulus. We do not believe this will happen because Europe still has some way to go to regain pre-pandemic levels of activity and has considerably more slack than the US, especially in the labor market, but we do believe that better momentum in Europe (vs. the US) can do much to detract from the relative attractiveness of the dollar.

In practice, both rate spreads and economic surprise spreads have been leaning in favor of the euro (weaker dollar), This trend is expected to become more pronounced in the coming weeks, especially if the Fed remains rather cautious in September.

If this is correct, expect better relative performance of Ex - US assets and higher commodity prices (due to denomination effect).