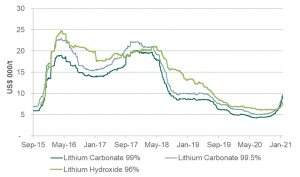

Demand visibility has been improving, due to all the incentives for renewable energies and electro mobility (accentuated by the pandemic and now with the Biden administration), and perfectly what we can start to see is a reversal of the price adjustment process we saw starting in 2018, due to an oversupply of lithium and moving very quickly to a deficit market, also considering that it is not so easy to materialize plant expansions and even less new projects.

The big winner in this new landscape is #SQM. Given its strong competitive position, it can respond faster than its competitors to this growth in demand and at a lower cost. Its comfortable level of leverage, coupled with a potential capital injection already approved by its shareholders, creates a growth potential that, in our view, the market is just beginning to incorporate without considering, additionally, the recovery of the lithium price .

SQM has been one of the positions that has contributed to the performance of our equity fund #FYNSA TOTAL RETURN, which since its inception has returned +3.5%, which compares positively with the -12.5% shown by the IPSA in the same period.