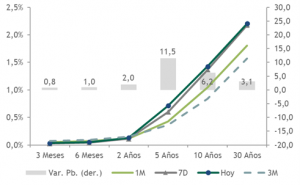

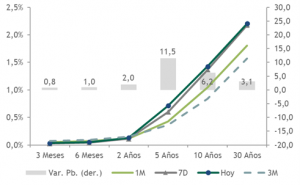

U.S. Treasury yields continue to be volatile, with the 10-year rate almost back to 1.5%. As we noted last week, three factors help explain the effect of higher rates on risk assets: the level of rates, the speed and the source of the move.

- The current level of interest rates remains relatively low and is therefore unlikely to be a major drag on risk assets. Moreover, in recent months, the yield curve has steepened as expectations of improved economic growth and higher inflation (as desired by the Federal Reserve) have increased.

- But the speed and source of rate movements in particular have been less friendly. Yields rose by more than 2 standard deviations, but without much increase in inflation expectations.

- This behavior of higher real yields and lower traded inflation generally corresponds to the market's perception of a tightening of monetary policy, something that is probably too early in the cycle for many central banks to consider.

The question that follows is what could the Fed do to dissuade the market from further pricing in a more forward normalization of monetary policy, or to curtail the levels of volatility we are seeing in the rate market, which is about to spiral out of control?

- The Fed may take action to reduce rates at the longer end. And this is where "Operation Twist" comes in, where you can buy long bonds and sell short bonds.

- The last time it was used was in 2011 to reduce long-term rates with the federal funds rate at zero. Back then, 10-year yields fell from 3.75% in February to a low of 1.43% right in the middle of 'Operation Twist 2' in July 2012.

- Thus, by implementing this strategy, the Fed could "kill three birds with one stone": it raises initial rates, stabilizes final rates, and does so in a reserve-neutral manner that decreases bank pressure (legal liquidity ratio) to hold more capital.

U.S. rate structure

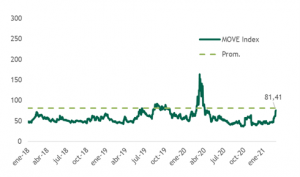

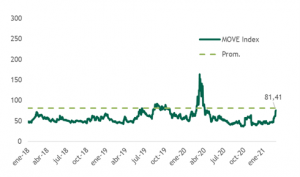

Volatility RF Move Index