During the last year we have seen how many sectors of the economy have been affected by the pandemic: airlines, tourism companies, hotels, real estate and construction companies are among the most affected. However, despite the adverse scenario, some sectors, such as warehousing, achieved positive numbers during 2020, and it is expected that they will continue to do so in the coming years.

Vacancy at historically low levels

Vacancy at historically low levels

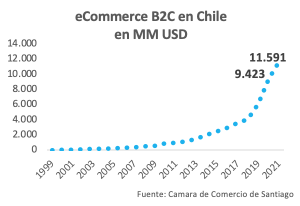

The great growth of e-Commerce and the needs of companies that have changed their business model, has increased the demand for square meters of warehouses. Thus we can see how the need for the physical store has decreased, appearing business models such as Dark Store and Dark Kitchens, which support online sales.

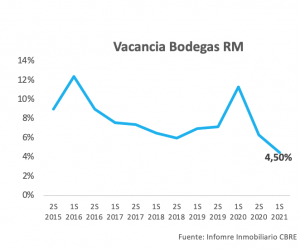

The warehousing market in Chile went from 11.34% vacancy in the first half of the year to 6.33% in the second half of 2020. As of the first quarter of this year, vacancy is around 4.5%.

In this context, and according to the latest global report on warehouses developed by GPS Property, the Class I and II warehouse market is consolidating as the most promising real estate market with the greatest growth opportunities for 2021, due to the main role it plays in the processes of optimization and modernization of logistics, which has meant the explosive growth of e-commerce.

Investment expectations

By 2021, it is estimated that more than 150,000 m2 of new warehouse space could enter the local market, with the entry of relevant players such as Amazon and Mercado Libre. Due to these factors, an increase in both supply and demand for warehouses is expected.

On the other hand, the main investors in this type of real estate assets are public and private investment funds, which have increased the proportion of warehouses in their portfolios. During the first quarter of 2020, 7 new warehousing funds were created, totaling assets of US$5 billion. As of December 2019, these investment vehicles had assets of US$4.4 billion, representing a growth of 13.6%.

Among the characteristics of these real estate assets that explain their boom and the current interest in investing in them are the low cost of construction, the added value of the property and the security generated by having lease contracts with productive companies.

The favorable market conditions of the warehousing business currently allow investors to prefer to invest in this type of assets, which are presented as an alternative to diversify portfolios and generate higher returns.